Imagine there were only two main strategies that could help you save for retirement. One of those strategies involves myriad fees and underlying costs that chip away at your returns year after year, while the other is remarkably inexpensive and easy-to-understand.

Knowing these details and these details alone, which option would you choose?

Obviously, most people would go with the latter strategy – the one with low costs and overhead. Right?

Sadly, that isn’t always the case. In the complex world of investments, financial advisors, funds, and fees, few people really understand what they’re paying for account management and how it can impact their returns over the long haul.

That’s why it’s important to know how many fees you’re paying for portfolio management, trades, and everything else. After that, you need to know what percentage of your portfolio these fees eat up.

Brace yourself.

Investing for the Long Haul: Fees to Understand

Depending on the type of investments you hold onto and who you use to manage your portfolio, any number of fees could be dragging down your bottom line.

While some are necessary and well worth it, others could be easily minimized if you were willing to change your investing strategy up a bit. Some common fees you should know and understand include:

- 401(k) Management Fees – These fees, often referred to as expense ratio fees, are charged by the firm hired to manage your 401(k). If your plan is sponsored by an employer, this might be out of your hands altogether. They could run anywhere from .5% to 2%, with the difference between those two percentages costing you big time.

- Financial Advisory Service Fees – Whether you’re using a personal financial advisor or a robo-advisor, you’re forking over a percentage of your portfolio over for their services. If you’re using a robo-advisor like Betterment, you may pay as little as .15% if you have at least $100,000 invested. With less than $10,000 invested, on the other hand, you’ll pay .35%. A study from Personal Capital found that average advisory fees from the big brokerage companies ranged from 0.82% up to 1.53%.

- Fees for your Underlying Investments – Even when you pay a professional to manage your portfolio, you’ll pay fees that cover the administration of your underlying investments. These can include mutual fund fees, fees for ETFs, or fees for any annuities you have. These fees are highly dependent on the investment at hand.

- Load fees – Some mutual funds charge front-end of back-end loads that serve as a type of sales charge. These loads can be anywhere from 3-7%, resulting in soaring out-of-pocket costs in some cases. According to an analysis from Sam Dogen of Financial Samurai, the popular American Funds, charges a front load fee of 5.75% – and that’s in addition to a high ongoing expense ratio. “If you invested $100,000 in AGTHX, you would have to pay an up front fee of $5,750, and then an ongoing expense ratio of 0.65% a year,” notes Dogen. “That’s kind of nuts, especially if you decide the fund is not for you the following year.”

- Transaction Fees – Typical transaction-related costs involved in investing include trading fees and brokerage commissions. If you trade often, these costs can be minimized by choosing a low-cost brokerage platform that doesn’t charge an arm and a leg. Scottrade, for example, is famous for charging just $7 per trade.

How to Decipher Your Fees

Here’s what’s funny. If you don’t do a lot – and I mean a lot – of digging, you may not ever understand the fees you’re paying and will pay for the duration of your wealth-building years. If you truly want to know, however, it helps to know where to look.

Fortunately, a U.S. Department of Labor ruling from 2012 began requiring 401(k) plan providers to disclose fees clearly and plainly each year to their participants. To find out what type of fees you’re incurring on a work-sponsored 401(k), the easiest thing to do is to break out your annual statement or check your 401(k) administrator’s website for details.

Reputable companies will follow the government’s guidelines and post fees clearly for all to see. If they don’t, call your company’s Human Resources Department and ask the hard-hitting questions there.

If your money is invested directly into a no-load fund company, on the other hand, your fees will be easier to understand. Most likely, you’ll pay an ongoing management expense and administrative fee. If you have an IRA invested with a broker or financial planner, you’ll face the added cost of paying for their services as well.

How Can You Cut Down on Fees?

If your investments are costing you more than you thought, well, it might be time to take a different approach.

Financial advisor Shannon McLay of The Financial Gym offers a few suggestions that can help. For example, if you’re searching for pooled investments, passively managed options like ETFs and Index Funds are decent, low-cost options to consider.

In general, however, mutual funds will charge higher fees, notes McLay. “There are a number of costs involved with supporting the sale of a mutual fund from portfolio managers, to traders, to research analysts,” she says.

McLay suggests avoiding mutual funds that charge a load fee, whether it’s on the front end of the sale or the back end.

“Load fees are either front-end, where you pay a fee to buy the fund or back-end, where you get charged a fee if you sell the fund before a period of time,” explains McLay. “Some funds will charge you as much as 5% upfront to buy the fund, and if you purchased a Small Cap fund in 2014, instead of being up 4.4% with the Small Cap market, you would have experienced a loss in your investment due to the front-end load fee.”

Robo Advisors Are An Emerging Alternative To Traditional Advisors

One more suggestion from McLay involves considering a robo-advisor like Betterment or Wealthfront, instead of a traditional financial advisor. Where a full-service advisor will generally charge at least 1% to manage your portfolio, robo-advisors can charge a whole lot less for similar services.

According to Sam from Financial Samurai, the vast majority of your investment portfolio should be invested in low-cost ETF index funds. “I’m talking an 80%+ allocation with the rest to seek multi-baggers if that is your desire,” he says. “For example, if you want to gain exposure to large-cap dividend yielding companies, consider VYM, the Vanguard High Yield Dividend ETF with a 0.09% expense ratio, compared to 0.5% – 1.2% for many other actively managed funds.”

The Best Way to See Your Investment Fees

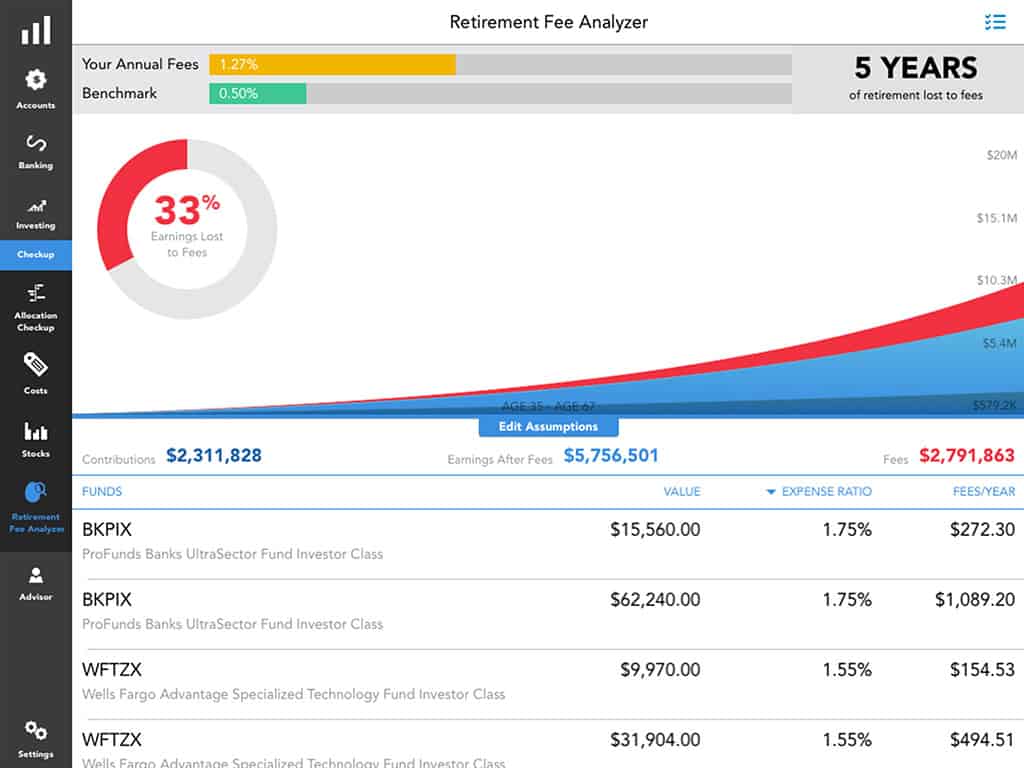

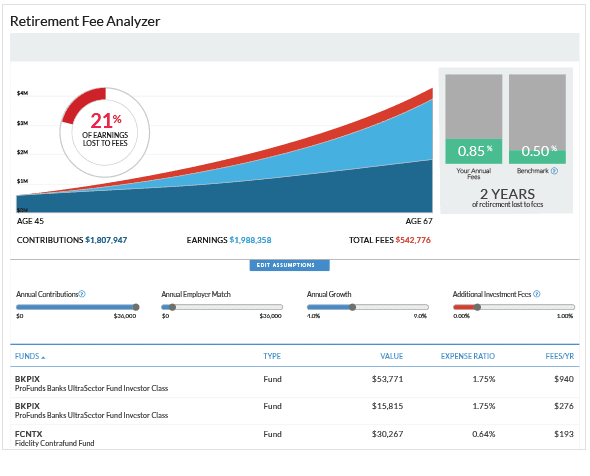

While you can dig through your investment fees and try to decipher them on your own, the best way to get a clear picture of what you’re paying is to sign up for a free account on Personal Capital and utilize their retirement fee analyzer. With this tool, you can see exactly how much you’re paying for your investments.

I’ve got several accounts hooked up to mine, and it clearly shows I am paying a lower percentage of fees overall when compared to the benchmark rate of .50%. Since most of my investments are in low-cost Vanguard index funds, I’m currently paying only .15%. And since I manage everything on my own, I’m not paying for a financial advisor or robo-advisor to manage my portfolio, either.

Personal Capital’s free retirement fee analyzer shows that a tiny 0.77% in fees can delay your retirement by a whopping 5 years

Personal Capital’s retirement fee analyzer also lets you see how your fees will play out over time. Using this tool, you can fumble around with your annual contributions and see how they might pay off and how your fees might change in the long run.

Since signing up for an account with Personal Capital is free, there is nothing holding you back from seeing how your ongoing fees really look. It only takes a few minutes to sign up and connect your retirement or brokerage accounts with this service, so what are you waiting for?

Think It Doesn’t Matter? Think Again

If you don’t feel like stressing over the fees you’re paying on your retirement accounts or other investments, you might be wise to rethink that position. While seemingly insignificant, the fees you’ll pay for ongoing account management and your investments can add up and affect your portfolio in ways you might not expect.

Take a recent analysis from the Center for American Progress, for example. The study looked at three 25-year-olds who saved the same amount of money for retirement, but with three different levels of fees associated with their accounts – one paying .25% of assets, another paying 1.00% of assets, and the last paying 1.30% of his assets.

If each worker saved 5% of their salary from age 25 until 67 and received a full match from their employer for a total contribution of 10%, they would have $476,745, $405,454, and $380,449 in their accounts, respectively (this assumes ongoing returns of 6.8 percent).

In other words, the individual paying the lowest ongoing costs would reach retirement with nearly $100,000 more stashed away. And remember, these three individuals stashed away the exact same amount of money for retirement every year.

The Bottom Line

Retirement savers and investors should be aware of the fact that the fees they pay matter – maybe even more than they think. A seemingly small increase in fees can wreak havoc on your investment returns is left unchecked. Fortunately, it doesn’t have to be this way.

The first step towards reducing your ongoing fees is finding out exactly what you’re paying and comparing it to the benchmark, or average. If your fees are over the top, consider your entire strategy – whether you’re paying for a full financial advisor or using a robo-advisor, mostly buying funds with loads or investing in low-cost index funds.

Every decision you make can and will matter in the long run. If you thought it didn’t matter before, it’s time to change your mind and take action. While you may not want to face your fees, the truth is, you can’t afford not to.

1 Comment