I know a lot of wealthy people and most of them share one characteristic:

They didn’t become wealthy from a conventional job.

It’s possible to build a big nest egg by working a typical 9-5, but it’s going to be a long road. The wealthiest people I know, and some of them are in their 30s, made their fortune by putting their money to work for them. Never, never, never forget this:

It’s much better to let your money work for you than to sell your own hours.

Think about it; would you rather sit in a cube for 2000 hours this year or let your money do all of the work? Any sane person would choose the latter.

And I know from experience. In the past 4 years, my investment portfolio has gone from $586,000 to $1,300,000. I didn’t make $700,000+ dollars from my job. Not even close. Most of my gain was from my money working for me. I love it.

Building Wealth

The wealthy folks I know have made their money with either long term stock market investing or through real estate, specifically residential properties. And most seem to be in one camp or the other. A landlord with 10 properties under his tool-belt once told me:

The stock market is like gambling. No way I’m touching that!

On the other hand, an uncle who adores index funds had no love for real estate:

No way I want anything to do with rental properties. I want my investments to be completely passive.

I believe that a wise investor should make room for both assets in their portfolio. To simplify the debate, I’m going to compare long term, index investing (the same kind that Warren Buffett recommends) to residential property rentals.

Passivity: Index Funds for the Win

No one will argue that index funds are the most hands-off path to wealth. An index fund will never call you to complain about a leak or skip out of town in the middle of the night. An index fund will never flush toys down the toilet. You’ll never have to get the sheriff involved with your index fund.

Rental properties are work. You need to find suitable properties and stock them with good tenants. You then have to perform (or coordinate) regular maintenance and fixes. In a worst case scenario, you may have to evict a tenant who has damaged your home.

The goal of any good landlord should be to make the rental as passive as possible. Enter your email below to download my 10 Unconventional Landlord Tips guide.

[thrive_lead_lock id=’2693′]

[/thrive_lead_lock]

Why I still like real estate: Real estate is work. However, even managing 10 properties will take up a fraction of the time of a full-time job. And if you can’t stand the thought of dealing with tenants, you can always hire a management company.

Control: Real estate Dominates

Real estate wins by a mile. You get to decide:

- The area your properties are located. Smart landlords know you don’t need to live close to your properties if you put the right systems in place.

- Which properties to rent.

- Who you rent your home to.

There is a lot of knowledge involved in becoming a successful landlord. However, if you take the time to educate yourself on the nuances of property management, you can do very well for yourself.

Over the short term, an index fund is subject to the whims of the greater market and world events that are out of your control. If unethical bankers do bad things (see the Great Recession) or a war breaks out, you could see half your nest egg evaporate very, very quickly.

Why I still like index funds: Over the long term, the stock market has created tremendous wealth. The solution to dealing with short term fluctuations is simply to ignore them. A big dip in the markets is nothing more than an opportunity to buy in at a lower cost. Ignore the news and stay the course. The losses are on paper; you only actually lose money when you sell for a lower price than you bought.

The best place to start investing in index funds with no fees is the Ally investing app.

Getting Wealthy: It depends…

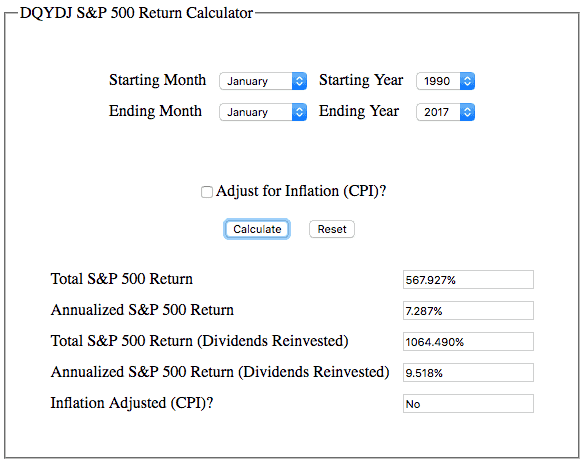

The market has taken some bad hits in recent history including the dot-com implosion of 2000, the attacks of 9/11 and the Great Recession. However, at the time of this writing (February 2017), if you put $100,000 into the markets in January of 1990, you’d have $1,064,490 today (S&P 50o with dividend reinvestment):

Can you tell that 3 big bad black swans showed up? Probably not.

Real estate is more difficult to measure since there are considerably more variables including your skills as a landlord. However, real estate heroes like Brandon Turner and Chad Carson, both in their 30s, are financially independent. With some hard work, it’s clear that real estate can be a quick path to wealth.

The Stock Market VS Real Estate

Which one is right for you? Before I get to the answer, let’s set some very basic rules:

Stock market investing:

- Index funds are the cornerstone: Buy low fee index funds. Don’t try to pick stocks.

- Stick with it: Warren Buffett famously said “Our favorite holding period is forever.” Don’t think in days, months or even years. Think in decades.

- 401(k)s rock: Take full advantage of your 401(k).

Real estate investing:

- Study before diving in: Educate yourself! Start with the 1% Rule and Cap Rates.

- Screen your tenants like you’re the FBI. And then some: A little work upfront will save you loads of pain later. Always choose good credit over good excuses.

- You don’t have to own property to be a real estate investor: I’ve been focusing on owning long term rentals up to this point, but there are some neat options if you’d like to invest in real estate passively. Crowdfunding platforms including Fundrise, Patch of Land, Realty Mogul, RealtyShares and PeerStreet allow you to invest in real estate from the comfort of your computer. Each company takes a slice of the profit. In return, you have a group of experts working full-time for you. Check out this comprehensive Fundrise review for more information.

Real Estate VS Stocks: Which one is Right for You?

I’ve had investments in the stock market for almost half of my life and have also owned rental properties. I love the diversification that owning both assets brings. A 30% drop in the stock market is much easier to tolerate when you have steady income from a rental.

Where you decide to deploy your money largely depends on your temperament. Real estate requires more work, but can be a quicker path to wealth. Index funds require minimal effort and you don’t need a large down payment to get started. However, I encourage you to explore both.

Never forget that the end goal is financial independence. The road you take to get there is completely up to you. And while financial independence is a wonderful feeling, don’t forget to enjoy the journey. Stop every once in a while to smell the roses (and hopefully not illegal cats in your rental). Work and save aggressively, knowing that a life without the worries of money is a good life.

4 Comments