SHARE THIS INFOGRAPHIC ON YOUR SITE WITH THE FOLLOWING CODE:

<p><a href='http://www.investmentzen.com/data-visualization/how-charitable-donations-can-be-a-wise-financial-strategy/'><img src='https://investmentzen-569f.kxcdn.com/blog/wp-content/uploads/2017/08/how-charitable-donations-can-be-a-wise-financial-strategy_infographic.jpg' alt='How Charitable Donations Can Be A Wise Financial Strategy' width='800px' border='0' /></a></p>

<p>Via: <a href="http://www.investmentzen.com/data-visualization/how-charitable-donations-can-be-a-wise-financial-strategy/">InvestmentZen.com</a></p>

According to the Wall Street Journal, back in the 1970s, when the top rate of federal income tax was 70%, wealthier Americans (people with incomes of over $500,000 in 2007 dollars) gave around twice as much of their money to charity than they did in 2007, when the top rate had fallen to 35%. People in other income brackets, on the other hand, saw smaller changes in their tax rates, and made smaller changes to their charitable giving.

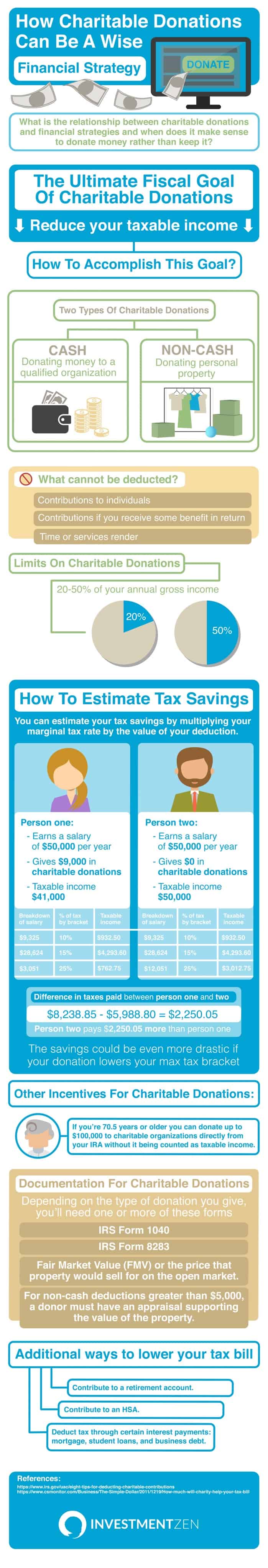

Donating to charity is obviously a kind gesture. But, it’s apparent there are also financial perks for doing so. So, what’s the relationship between charitable donations and financial strategies? When does it make sense to donate money as opposed to keeping it for yourself.

Donations to qualified charities are considered tax deductible expenses so they can reduce your taxable income, lowering your tax bill. There is a chance that donating to charity can lower your tax bracket, too.

What that means for savings

If your itemized deductions exceed your standard deduction without your charitable donations, you can estimate your tax savings by multiplying your marginal tax rate by the value of your deduction. For example:

If you make $50,000 per year, and donate $9,000 to charity, you have $41,000 in taxable income. ($50,000-$9,000).

By tax bracket, here is the amount of taxes owed.

For the first $9,325 a person has to pay 10% of the income in taxes. That’s $932.50

For the next $28,624 of that (the $9,326 to $37,950 bracket), that person has to pay 15% of the income in taxes. That’s $4,293.60.

For the rest of the pay, $3,051, a person would be in the $37,951 to $91,900 bracket, which means that person has to pay 25% of that portion of his income in taxes. That’s $762.75 for this bracket (25% of $3,051).

To figure up the person’s total tax bill, they simply add together those pieces, which totals $5988.85. Without the charitable donation, $12,051 amount would be charged at the 25%, which would have cost $3,012.75 or $2,250 more in taxes.

If charitable donations drop you to a lower tax bracket, you could save even more. You can use this giving calculator to estimate your tax savings.

What Qualifies As A Charitable Donation?

There are two types of charitable giving:

- Cash

- Non-Cash or ‘Stuff’

Cash donations

You can donate money to any number of charities, as long as they are a charity recognized by the IRS regulations. Qualified organizations include a US state if the money is used for public purposes, religious organizations, or organizations that exclusively serve charitable, literary, or scientific purposes, among others. See IRS Publication 526, Charitable Contributions, for rules on what constitutes a qualified organization.

Non-cash donations

Non-cash donations include property like land, vehicles or clothing. In order for your non-cash donations to qualify, you’ll need detailed records of the fair market value of that property.

Fair market value (FMV)

When donating non-cash items, you’ll need to provide a complete list of what you are donating (for instance, four men’s shirts, three men’s pants, five women’s blouses, etc.) The more detailed the better: Break it down by color, attach images, provide dates and of course, the FMV – or what an item is worth.

There are many apps and lists one can find online that helps you determine the FMV of hundreds of items. Additionally, both Goodwill and Salvation updates their lists every year.

Whether you donate money or property, it’s important to keep good records.

What Are The Limits On Charitable Donations?

It is impossible to eliminate your tax liability, but you can reduce it by a fraction of the amount donated to charity. Of course, there are limits to reducing your tax obligations.

Amounts donated to charity are a below-the-line deduction to gross income (itemized tax deduction); and limited to 20-50% of gross income in any given year (excess may be carried forward).

What Cannot Be Deducted?

- You can’t deduct contributions to individuals.

- You also can’t deduct contributions if you receive some benefit in return.

- You also can’t deduct your time or services you render.

Other Considerations For Charitable Donations

Many retirees above age 70 must distribute money out of their 401ks and Individual Retirement Accounts (IRAs) and pay taxes on those distributions, also known as required minimum distributions (RMDs). Instead of keeping the RMD that isn’t needed, an investor can recommend a strategy to give the RMD directly to charity and completely avoid taxes.

A step further would be to change the IRA to a Roth IRA which will eliminate the RMDs altogether and enable someone to leave the entire asset tax free to their beneficiaries. This conversion to a Roth IRA will result in income taxes in the year the conversion is made, but that income could be offset by a tax deduction received from a simultaneous contribution to a donor-advised fund (DAF).

Tax Forms For Charitable Donations

- Donors would report their deductions for charitable contributions on lines 16 through 19 of Schedule A to IRS Form 1040 (the annual individual tax return).

- Gifts of $250 or more must be supported with a statement from the charity.

- If you give a total of $500 of non cash in any one year, you have to itemize them on form 8283.

- If any one item has a FMV of over $5,000, you have to get a formal appraisal and fill out a separate part of the 8283.

It’s important to note that donations of property are especially prone to scrutiny.

Additional Ways To Lower Your Tax Bracket

If charitable donations aren’t the right fit for you, here are three additional ways you can lower your tax bracket.

- Contribute to a retirement account.

- Contribute to an HSA.

- Deduct tax through certain interest payments: mortgage, student loans, and business debt.