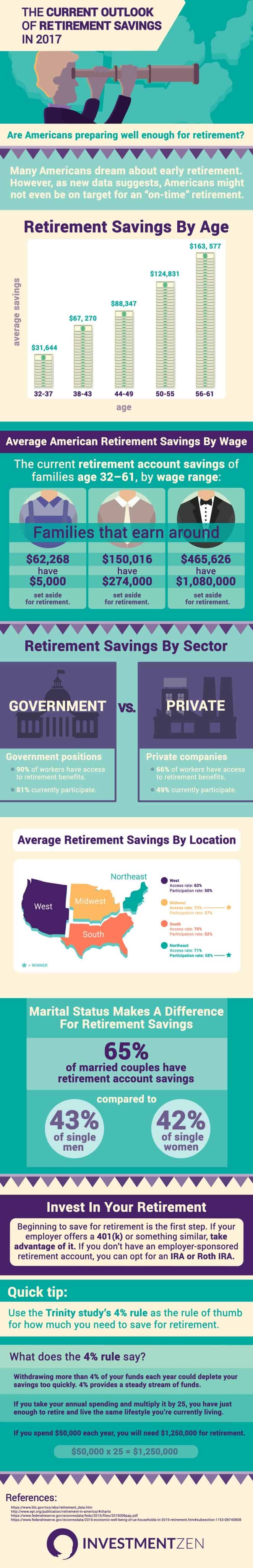

Many Americans dream about early retirement. However, as new data suggests, Americans might not even be on target for an “on-time” retirement. As you’d expect, the amount someone has stashed in a retirement account will vary by age, wage and geographic location. However, nationwide, the decline in overall retirement contributions is alarming.

Let’s look at the current outlook of retirement savings in America, and some steps you can take to ramp up your contributions and get back on track for the goal of early retirement.

SHARE THIS INFOGRAPHIC ON YOUR SITE WITH THE FOLLOWING CODE:

<p><a href='http://www.investmentzen.com/data-visualization/average-household-debt-in-america/'><img src='https://investmentzen-569f.kxcdn.com/blog/wp-content/uploads/2017/07/SEO-The-Average-State-Of-Retirement-Savings-In-America-In-2017.jpg' alt='SEO: The Average State Of Retirement Savings In America In 2017' width='800px' border='0' /></a></p>

<p>Via: <a href="http://www.investmentzen.com/data-visualization/average-household-debt-in-america/">InvestmentZen.com</a></p>

The high-level look at today’s retirement progress

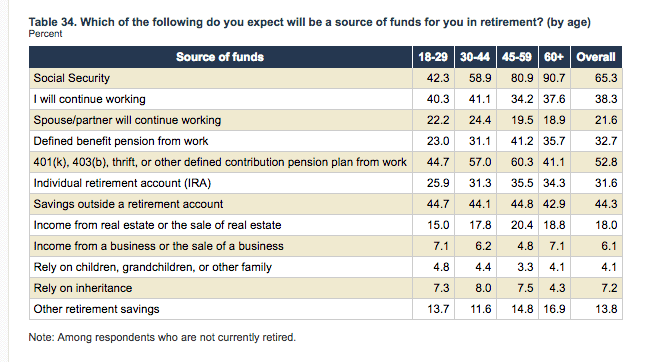

The Federal Reserve details where each age group believes their source of retirement income will come from. And for those aged 60 and over, 90.7% believe that some of their retirement funding will come from social security, this is a drastic difference than those aged 18-24 who primarily believe their own savings contributions will allow them financial security in their retirement age. Still the three most common sources of funding, for all age groups, is social security, 401(k) or other defined contribution pension plan from work, and/or a savings account outside of a retirement plan.

(Photo/Federal Reserve)

Retirement account savings have exceeded pension fund assets since 2012, as well as briefly in the late 1990s and mid-2000s. Unfortunately, assets in retirement accounts are voluntary, which means that as the economy or personal financial situations change, people may forgo contributing toward their retirement, or may withdrawn accumulated funds.

According to the National Retirement Risk Index (NRRI), it’s likely that about half of today’s working-age households won’t be able to maintain their preretirement standard of living in retirement. Retirement wealth has not grown fast enough to keep pace with an aging population and other changes.

What does retirement savings by age look like in today’s workforce?

Average retirement savings by age

According to the Federal Reserve, nearly half of those ages 18 to 29 report that they have no retirement savings or pension, whereas approximately three-quarters of non-retirees age 45 or older have at least some savings.

As of 2013, the mean retirement savings by age – of those with savings – are as follows, according to the Economic Policy Institute (EPI):

- 32-37 – the mean savings for this age group is $31,644

- 38-43 – the mean savings for this age group is $67, 270

- 44-49 – the mean savings for this age group is $88,347

- 50-55 – the mean savings for this age group is $124,831

- 56-61 – the mean savings for this age group is $163, 577

Over the last decade, participation in retirement has fallen. The EPI believes that families headed by working adults aged 32–61 have lessened retirement plan participation from 60% in 2001, to 53% in 2013.

Average American Retirement Savings By Wage

How much someone earns will also greatly determine one’s ability to stash away funds in a retirement account. For all wage ranges, what are the average retirement savings?

Nearly half of working-age families have nothing saved in retirement accounts.The retirement account savings of families age 32–61 by wage percentile as of 2013 are as follows:

- A family in the 50th percentile of wage earnings, or around $62,268, had only $5,000 set aside for retirement.

- The 90th percentile family who makes around $150,016 had $274,000.

- The top 1%, or families that earn more than $465,626 had $1,080,000.

The 50th percentile wage earner, or the median wage in America, is representative of 50% of America’s workforce, which may include workers edging near retirement age.

Do all Americans have access to retirement plans?

Average retirement savings by sector

For government positions the Bureau of Labor Statistics measures, on average, 90% of workers have access to retirement benefits, though only 81% currently participate. Southern states have the highest access to government retirement plans at 92% though only 82% of employees participate. Government employees in Western states have a slightly higher participation rate at 83%.

For private companies, the BLS measures 66% of workers have access to retirement benefits, and only 49% participate. The Midwest has the highest access at 70% of workers, yet only 53% of workers participate. North Eastern states have the highest participation rates at 55%.

Average retirement savings by state

Civilian positions, as recorded by the BLS, take into consideration all private industry, state, and local government workers. With that in mind, 69% of all civilian workers have access to retirement benefits, but only 54% participate.

Civilian employees in the midwest, specifically west north central (North Dakota, South Dakota, Minnesota, Nebraska, Iowa, Missouri and Kansas), have the highest retirement plan availability rate. 75% of workers in these states have access to retirement plans.

The Northeast, New England specifically, has the highest participation rate for retirement plan. In Maine, Vermont, New Hampshire, Rhode Island and Connecticut, 59% of workers participate in their retirement programs.

Here is a breakdown of civilian occupations and their access and participation rate by region:

- West

- Access rate: 63%

- Participation rate: 50%

- Northeast

- Access rate: 71%

- Participation rate: 58%

- South

- Access rate: 70%

- Participation rate: 52%

- Midwest

- Access rate: 73%

- Participation rate: 57%

Marital status makes a difference for retirement savings

Nearly two-thirds (65%) of married couples had retirement account savings in 2013, compared with 43% of single men and 42% of single women.

Invest in your retirement

Beginning to save for retirement is the first step. If your employer offers a retirement plan, If your employer offers a 401(k) or something similar, take advantage of it. If you don’t have the option for an employer-sponsored retirement account, you can opt for an IRA or Roth IRA. You can invest in stocks and bonds.

How to estimate how much you’ll need for retirement

How much of your salary do you currently spend, annually? Will you spend more or less in retirement? Let’s assume you currently spend 50% of your paycheck, annually:

Scenario 1: Below average (spending 15% less than your current lifestyle)

If you are able to live low-cost during retirement, you might be a below average retiree – or someone who can cut expenses by at least 15% each year. This means, in retirement, you might be able to get away with saving 35% of your annual salary, for each year of your retirement.

Scenario 2: Average (spending the same as your current lifestyle)

If you plan to spend the same amount of money in retirement as your current lifestyle, that makes you an average retiree. This means if you spend 50% of your paycheck currently, you’ll need to plan to save 50% of your annual salary for each year of your retirement.

Scenario 3: Above average (15% more than your current lifestyle)

If you plan to travel or increase your spending during retirement you are considered an above average retiree. This means you will spend 15% or more than your current lifestyle. This also means you’ll need a higher savings stash upon entering retirement. If you spend 50% of your paycheck currently, you’ll need to plan to save at least 65% of your annual salary, for each year of your retirement.

Quick tip

You’ve done all the work to save for retirement, so now you need to make sure you spend your savings wisely.

Stick with the 4% rule

This rules determines the amount of funds to withdraw from a retirement account each year. Regardless of the type of retiree you are, withdrawing more than 4% of your funds each year could deplete your savings too quickly. The 4% rule provides a steady stream of funds to a retiree, and if you saved properly, also maintains a positive account balance for the number of years you’re retired for.

To find how much you’ll need to save for retirement, in your personal situation, use a retirement calculator.

[ Featured image credit: 401kcalculator.org | Flickr ]

2 Comments