There’s no shortage of hot stock tips these days. The question is: Who has the best stock picking record? And what criteria do you use to determine that? To help you decide, in this article I’ll highlight our partner website, WallStreetZen, and its powerful stock analyst rating backtesting tool.

As more people are investing in stocks part-time to save, protect, and grow their wealth in strong corporate equity assets, the number of stock picking services has also grown dramatically in recent years.

With this swell of stock advisors, financial bloggers, and analyst ratings, it can be tough for a newcomer to sort through all the noise and see who has the best stock picking record so they can follow the smart money.

With so much information thrown at you, are stock picking services even worth it (here’s a review of the best stock picking services)? You’re in the right place. I’ll show you how WallStreetZen’s analyst features gather all that information for you. It makes stock picking from reliable analyst ratings a breeze.

The Problem With Most Stock Picking Services

First, here’s the big problem with stock picking that these services solve: As 24-year Wall Street and stock market correspondent Bob Pisani said it when writing for CNBC’s massive audience of engaged investors and financial news junkies on Sept 18, 2020, “Stock picking has a terrible track record, and it’s getting worse.”

For the article, Pisani interviewed Larry Swedroe, the Chief Research Officer for financial advisory firm Buckingham Strategic Wealth, and author of “The Incredible Shrinking Alpha.” Swedroe said:

“[Active portfolio management is] bad and it’s getting worse. Every year, S&P Dow Jones Indices does a study on active versus passive management. Last year, they found that after 10 years, 85% of large-cap funds underperformed the S&P 500, and after 15 years, nearly 92 percent are trailing the index.”

He says that in practice, most “[s]tock pickers can’t identify underpriced stocks with any regularity.”

An Investopedia article by Michael Schmidt, published on Mar 4, 2021, headlined “Is stock picking a myth?” has more bad news for stock picking:

“Depending on what periods you focus on, the S&P 500 typically ranks above the median in the actively-managed universe. This means that usually at least half of the active managers fail to beat the market. If you stop right there, it’s very easy to conclude that managers cannot pick stocks effectively enough to make the process worthwhile.”

That might be enough to make anyone throw in the towel and settle for whatever an index mutual fund returns to them for their investment. But don’t give up just yet.

In fact, half of the active fund managers on Wall Street also beat the benchmark indexes consistently. The best stock prediction websites tell you exactly who they are, show you the historical performance of their Buy, Sell, and Hold ratings, and alert you with their latest stock picks.

Are Stock Picking Services Worth It?

So if most of the financial analysts don’t beat the U.S. stock market benchmarks like the S&P 500 Index, the Dow Jones Industrial Average, or the NASDAQ Composite—are stock picking services worth it? Are they worth your time or their monthly subscription fees? Depending on your level of investing knowledge and experience, as well as your individual needs based on your savings or investing goals—yes!

And just like the particular stock analyst, it also depends on the specific stock picking website. The key for investors is to find one that’s reliable, trustworthy, and has a good track record of delivering solid returns. Benzinga Options boasts one of the highest win rates of all. Still, you’ll need to find the a site that works for you.

Even the best free stock picking service out there in terms of how much data powers it and the successful track record of its stock tips won’t be worth it if you can’t realistically learn how to navigate that website’s ratings and rankings to find your best stock picks. Alternatively, it’s even possible to copy eToro traders if you find one with a solid track record.

Who Analyzes Stock Analysts?

Remember the statistic from the CNBC article above. Over a 10-year period, 85 percent of large cap Wall Street hedge funds’ actively managed stock portfolios performed worse than the broad U.S. stock market benchmark, the S&P 500 Index.

That’s a depressing statistic when you consider the amount of money those giant Wall Street hedge funds have under management. The definition of a large cap fund is one with $10 billion or more in AUM (assets under management). And wealthy investors pay them massive commission fees to beat the stock market averages.

When you zoom out to the 15-year timeframe, that figure became an astounding 92 percent of hedge funds—with career investment finance professionals looking after them—that failed to do any better than the S&P 500. They failed to do better than just average for their high-paying clients.

How do you zone in on that 8 percent of professional Wall Street analysts who have the best stock picking record? And deliver far above average returns to investors who heed their Buy, Sell, and Hold ratings in time? It’s actually easy: You use the best stock prediction websites that compile all that information in one place, and keep tabs on the over-performers’ latest stock picks.

It may be too bad that the old money simply does what the generation before them did, simply because that’s what the generation before them did, and it worked well enough for them. But when you’re talking about the kind of sums that are entrusted to hedge funds, it might not make a difference to institutional money whether their principal earns 10 percent in a year or 50 percent.

The main goal of people who invest with hedge funds is not to smartly grow their savings for retirement, or a house, or a college fund. Their main goal is very conservative: simply not to lose generational money or a big payoff from selling a large company they started, hence the term, “hedge.”

But to most retail investors, especially those with long timeframes to invest over, the compounding effect of an extra 5%, 10%, or 25% of annual ROI will make an enormous difference in their life (see more: How to Get a Guaranteed 10% Return on Investment). So if that’s you, please read on for some good places to start.

WallStreetZen’s Analyst Data-Driven Stock Picking Tool

WallStreetZen, our partner website, helps you narrow down the analyst targets and ratings so you don’t have to put in hours slogging through every analyst’s history yourself. Instead of going through each and every analyst individually, armed only with Google, checking through all their past stock picks then pulling up a chart to see how they did, WallStreetZen has already done that for you.

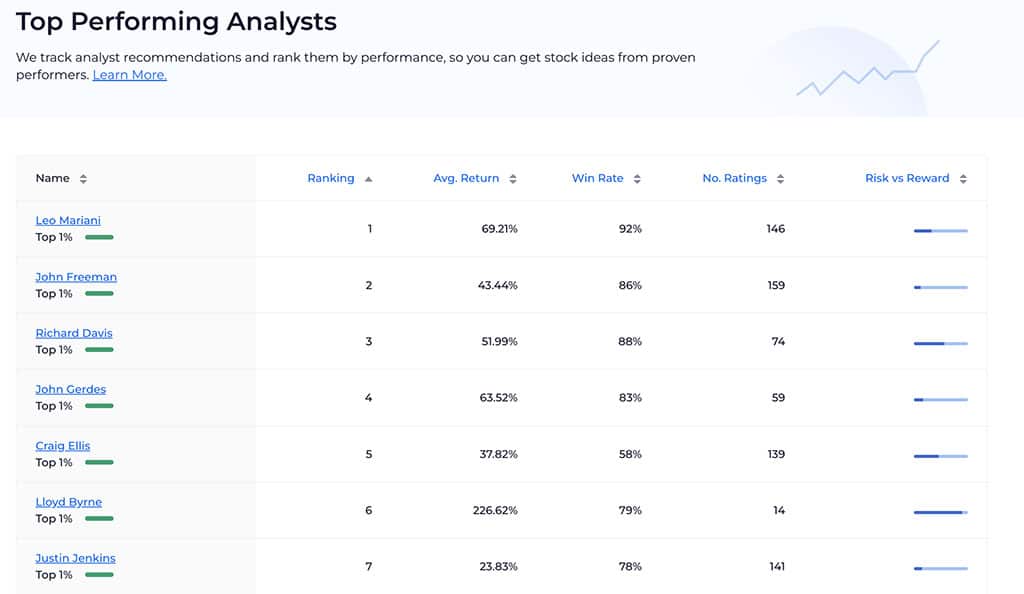

Not only does the website have a curated list of the Top 1% of the best performing Wall Street analysts, this free stock picking service also backtests their ratings.

On the Top Performing Analysts page, the list gives you a breakdown of the analysts’ site ranking, average return (some have +200% and +300% yearly returns), win rate (the percent of forecasts that were profitable), total number of rankings in the site’s database, and the analyst’s risk-reward score.

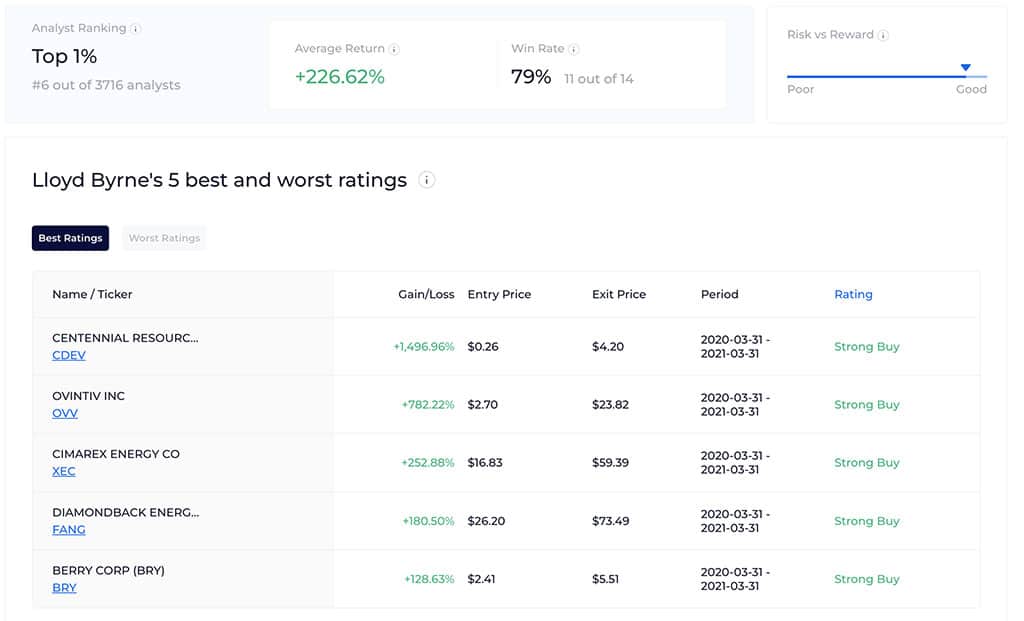

You can drill down from WallStreetZen’s list of stock analysts who have the best stock picking records, and click on each individual analyst to go to their own page on the website. So say your eyes pop out when you see that Lloyd Byrne has an average annual ROI above 200%, and you want to see what he’s recommended.

When you click on his name, you’ll find his stock picks with the Top 5 Best and Worst performance. WallStreetZen shows you the name of the company and its stock ticker, and tells you the Gain/Loss percentage, entry price, exit price, period, and the analyst’s rating at the time of entry. Then you get a list of all that analyst’s stock ratings starting with the most recent.

Best-Rated Stock Picking Services In Summary

If you don’t have time to research every stock analyst’s performance record, WallStreetZen has you covered. Not only does the website put all that information in one place for you, it does rigorous backtesting on analyst strategies. That means the site’s proprietary algorithm looks to the past and sees how their ratings would have performed in previous markets.

Backtesting is a powerful method in a trader or investor’s toolkit. But you don’t have to get out a spreadsheet and do the tedious work of entering in all the values for the historical data yourself.

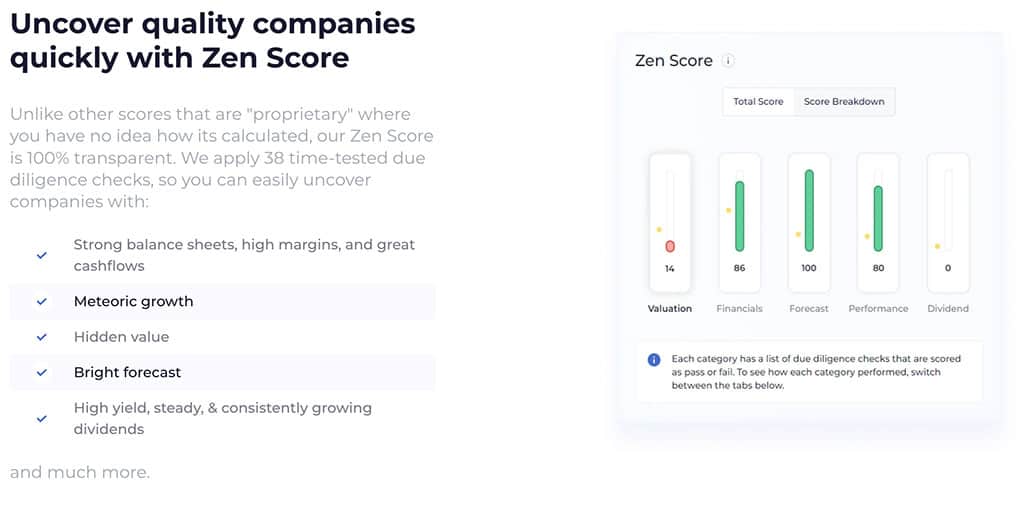

WallStreetZen also has a unique Zen Score for every stock, that uses fundamental analysis to score each stock and presents the information in a readable, understandable form. The score is composed of a company’s: Valuation, Financials (P/E, D/E, ROE), Forecast, Performance, and Dividend. WallStreetZen is free to use, but has a popular premium version that you can try out today for just a dollar.

WallStreetZen also has a great blog where they’ve reviews the best investment newsletters, the best stock market simulators, the best stock analysis software, the best portfolio trackers, and more.