SHARE THIS INFOGRAPHIC ON YOUR SITE WITH THE FOLLOWING CODE:

<p><a href='http://www.investmentzen.com/data-visualization/how-banks-use-big-data-and-what-it-means-for-the-future-of-banking/'><img src='https://investmentzen-569f.kxcdn.com/blog/wp-content/uploads/2017/10/How-banks-use-big-data-and-what-it-means-for-the-future-of-banking.jpg' alt='How Banks Use Big Data and What it Means for the Future of Banking' width='800px' border='0' /></a></p>

<p>Via: <a href="http://www.investmentzen.com/data-visualization/how-banks-use-big-data-and-what-it-means-for-the-future-of-banking/">InvestmentZen.com</a></p>

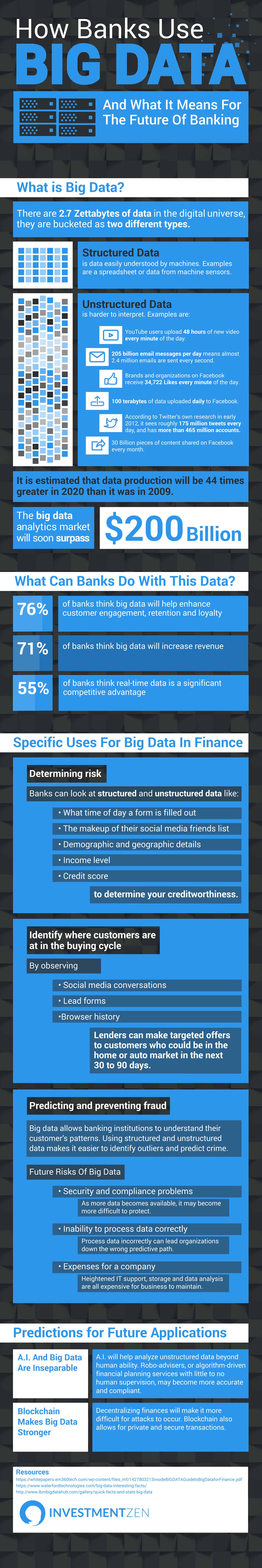

What is big data?

Big Data is a phrase used to describe the massive volume of both structured and unstructured data collected and stored. Big data is valuable to businesses because it opens the door to breakthroughs – a better understanding of their industry, and customers.

Structured data vs. unstructured data

According to Waterford Technologies, there are over 2.7 Zettabytes of data exist in the digital universe, as of 2017.

Some of this data is structured; written in a way that machines can easily understand like spreadsheets and data from machine sensors.

Unstructured data is more difficult to collect and process but gives a better depiction of a person. Consider this type of unstructured data, Waterford Technologies has aggregated:

- YouTube users upload 48 hours of new video every minute of the day.

- 205 billion email messages per day means almost 2.4 million emails are sent every second.

- Brands and organizations on Facebook receive 34,722 Likes every minute of the day.

- 100 terabytes of data uploaded daily to Facebook.

- According to Twitter’s own research in early 2012, it sees roughly 175 million tweets every day and has more than 465 million accounts.

- 30 billion pieces of content shared on Facebook every month.

CSC predicted in 2013, that data production will be 44 times greater in 2020 than it was in 2009.

All of this data means something. And businesses are determined to find exactly what that is. Though it seems there are great differences in ability to use the information. As of 2012, only 23% of organizations had assessed an enterprise-wide big data strategy. The research firm International Data Corp. is forecasting that the market for Big Data will grow at an annual rate of 23% through 2019.

What can banks do with this data?

Big data is still very much an unknown.

Most professionals understand there is an application for the data, but figuring out how to put it to work remains a challenge. The finance industry, in particular, understands the eventual advantages. Bankers want to understand client behavior and market trends to make logical and customizable decisions. In investing, AI is starting to be used to give suggestions to investors on how to invest, and many see it as the future of finance.

According to a survey conducted by Dell and Intel:

- 76% of banks believe data will help improve customer engagement, retention and loyalty

- 71% of banks think big data will increase revenue

- And 55% of banks think real-time view of data will provide a competitive advantage.

The information can help banks target resources more effectively. Here are some specific examples:

Determining risk

According to an EY white paper in 2014, 72% respondents believe big data can play a key role in fraud prevention and detection.The survey includes 466 interviews across 11 countries in a variety of industries. The primary job titles are specific to legal, finance, and compliance. 90% believe forensic data analytics can improve risk assessment.

Lending Club currently uses big data to assess the risk of consumers through online applications. Data points, both structured and unstructured like:

- What time of day a form is filled out

- The makeup of their social media friends list

- Income level

- Credit score

- Demographic and geographic details

Are all used to compile a true risk assessment.

Targeting consumers, strategically

Consumers can experience increased conveniences in banking and financial services through the use of big data.

Banks are starting to use data to determine where a customer is in their buying cycle. They then are able to make geographically specific and customized offers to their customers.

For instance, after close observation of a potential borrower, a bank can make targeted offers to customers who could be in the home or auto market in the next 30 to 90 days.

As the ability to read unstructured data becomes easier, this will become a more accurate and widely-used practice.

Predicting and preventing fraud

Big data allows banking institutions to understand the patterns of activity among their customers. With a more robust picture of consumer use, it’s easier to identify outliers and therefore predict crime.

Email is the most significant source of fraud, and cloud email security with management is necessary to protect every business against ransomware and phishing attacks. Guardian Digital’s EnGarde Cloud Email Security takes a multi-layered approach to prevent businesses from falling victim to email fraud. Their sender fraud protection helps prevent these types of attacks by verifying the authenticity of the sender’s email address. Advanced technologies like AI, Machine Learning, and Big Data analyze each message to ensure banks and credit unions are protected from these threats.

HSBC, for example, is among the leaders in the industry when it comes to taking preventative measure. Harvard Business Review explains how they have improved fraud detection, false-positive rates, and fraud case handling by using analytics to monitor the use of millions of cards in the United States.

Risks for future use

While there are clear upsides to the use of big data in the finance vertical, there are also risks. As the volume of big data continues to grow, organizations are faced with:

Security and compliance problems

- Big data is valuable on the black market. As organizations purchase and store more, they become more liable to protect personal information. Cybersecurity strategies become crucial.

- Data theft and attacks are growing. They are more common and more damaging than ever. JP Morgan Chase and Equifax for example, are two of the most damaging breaches in the last two years.

Inability to process data correctly

- Data is difficult to interpret, and without proper internal hierarchy and process to handle the information, it’s easy to miscalculate or mismanage data. Poor data can cost 20%–35% of a business’ operating revenue.

Outpacing IT capabilities

- In order to keep pace with security measures, IT becomes an increasingly important role. It is projected that data is growing by 40% per year and IT spending is lacking at only 5% growth.

Expenses for a company

- Data collection, aggregation, storage, analysis, and reporting all cost money. The more reliant a company becomes on their data, the more costs they can expect to incur.

Predictions for future applications

AI and big data will change how we work with financial services companies. Machine learning can analyze unstructured data, including social media, intracompany communication and linguistics beyond human ability. Robo-advisers, or algorithm-driven financial planning services with little to no human supervision, may become more accurate and compliant.

Blockchain technology has the ability to be a game-changer. Essentially, blockchain is a public ledger of transactions. Transactions in the blockchain cannot be altered, providing the potential for fully transparent, fully trustworthy financial advice in real-time.