SHARE THIS INFOGRAPHIC ON YOUR SITE WITH THE FOLLOWING CODE:

<p><a href='http://www.investmentzen.com/news/the-surprising-identity-of-the-average-couponer/'><img src='http://www.investmentzen.com/blog/wp-content/uploads/2017/02/the-surprising-identity-of-the-average-couponer_infographic.jpg' alt='The Surprising Identity Of The Average Couponer' width='718px' border='0' /></a></p>

<p>Via: <a href="http://www.investmentzen.com/news/the-surprising-identity-of-the-average-couponer/">InvestmentZen.com</a></p>

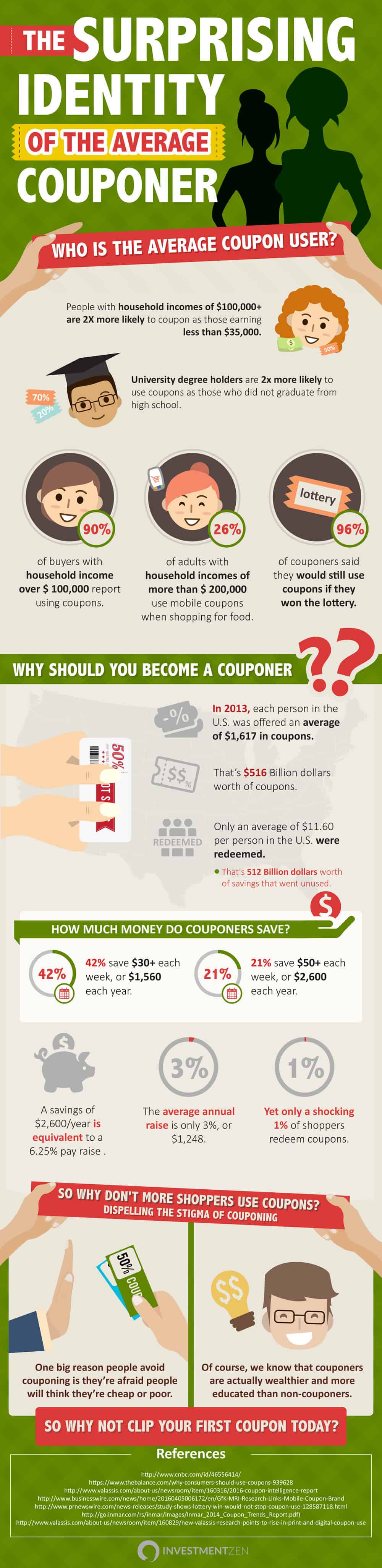

The Surprising Identity of the Average Couponer

Who is the average coupon user?

- People with household incomes of $100,000+ are 2x more likely to coupon as those earning less than $35,000.

- College-degree holders are 2x more likely to use coupons as people that did not graduate from high school.

- 90% of shoppers with household incomes over $100,000 report using coupons.

- 26% of adults with household incomes over $200,000 report using mobile coupons when shopping for food.

- 96% of couponers say they would still coupon if they won the lottery.

Why Should You Become A Couponer?

- In 2013, each person in the U.S. was offered an average of $1,617 in coupons.

- That’s $516 Billion dollars worth of coupons.

- Only an average of $11.60 per person in the U.S. were redeemed.

- That’s $512 Billion dollars worth of savings that went unused.

How Much Do Couponers Save?

- 42% of surveyed coupon users report saving $30+ weekly with coupons, or $1,560/year

- 21% save $50 or more each week, or $2,600 a year.

- A savings of $50/week with coupons effectively increases your income by $2,600/year.

- A savings of $2,600/year is equivalent to a 6.25% pay raise.

- The average annual raise is only 3%, or $1,248.

- Yet only a shocking 1% of shoppers redeem coupons.

Dispelling The Stigma Of Couponing

One big reason people avoid couponing is they’re afraid people will think they’re cheap or poor.

Of course, we know that couponers are actually wealthier and more educated than non-couponers.

Which group do you want to be in?

2 Comments