Up until a couple years ago, I didn’t know what an index fund was. In case you don’t know:

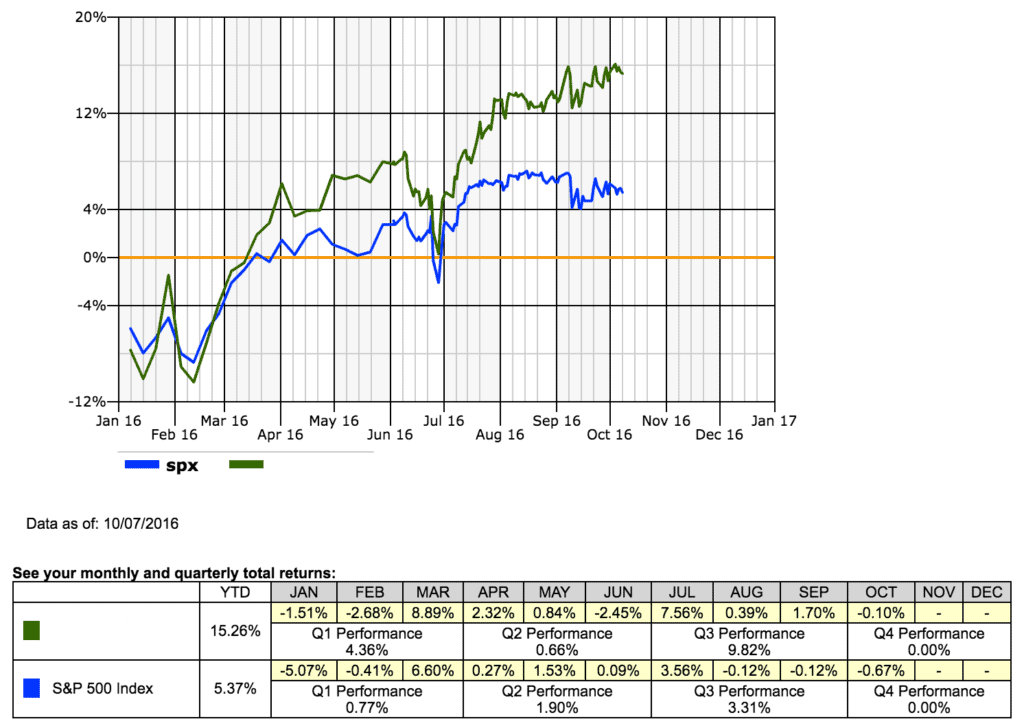

Before I learned about index funds, I was a stock picker. And I was really good at it. It’s true that I’m probably one of the most successful stock pickers you know. Here are my returns for 2016 where I’m currently beating the S&P 500 by almost 10% (the green line is my portfolio):

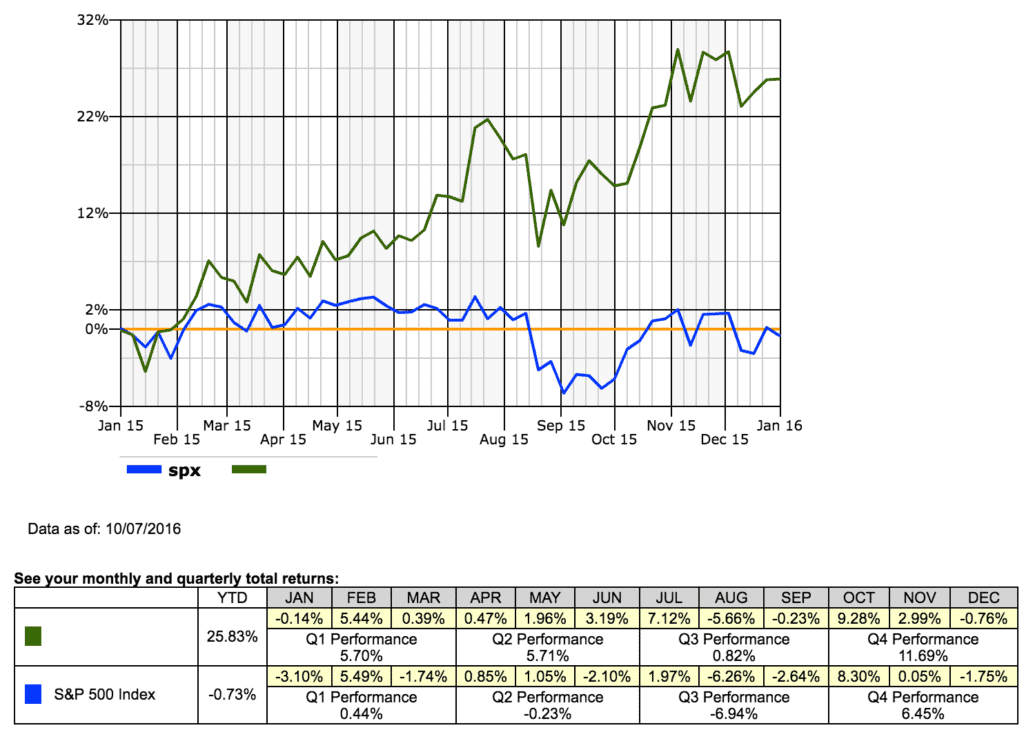

In 2015, I absolutely clobbered the markets, outperforming the S&P 500 by 26%:

My stock picking success goes back much farther than two years though. I’ve made loads of money on Google:

Facebook now sits at about $130 per share. I bought many of my Facebook shares for under $30:

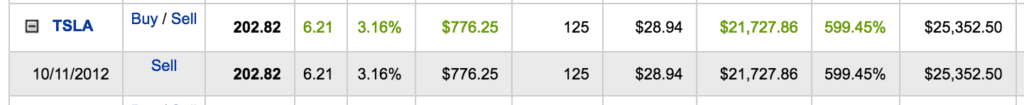

I’m up almost 600% on buying Tesla stock:

I’ve had a few duds too, but even accounting for those, I’m outperforming the indices by a large margin..

I’m going to tell you something even more incredible. I’m putting it in big font for extra emphasis:

Stock picking is a horrible idea. I’m firmly in the index fund camp now.

I know you’re probably very confused right now. Allow me to explain.

How I Learned to Stop Stock Picking and Love Index Funds

First, let’s review what an index fund is. It is simply an investment that tracks the holdings of a certain index. If you own an S&P 500 index fund, you own all of the holdings in the S&P 500.

This differs from an actively managed fund where a fund manager chooses the holdings. Because of the lack of active management, an index fund has very low fees.

Over the long term, fees make a huge difference in portfolio performance. Just as important, it’s very hard to pick market out-performers over the long term. For more on why index investing is such a sound strategy, see the excellent book The Little Book of Common Sense Investing.

Despite my success, I’ve been stepping away from stock picking. The reason is simple: I feel that I’ll earn more money over the long term with index funds. Here is why:

The professionals can’t do it: Most actively managed funds can’t beat the indices. Funds are managed by Ivy League MBAs that have teams of people to perform research. If the smartest people in the world can’t beat the indices, how does a normal person have a chance?

I’m lucky: How have I done so well then? I fully acknowledge that at least part of my success is due to luck. I bought Google stock because I thought the company was cool and its search engine was useful to me at work. I had no idea that Google would go on to create multiple products with over a billion users. Luck played a part in my success.

The speed of disruption is increasing: Innovation is happening faster than ever now. Remember how cool and what a massive improvement the original iPhone was when it was introduced less than 10 years ago? It’s incredible, but true that all phones will be dinosaurs as technology gives way to devices with other form factors (watches, glasses, implanted devices) that utilize augmented reality and artificial intelligence.

Auto companies are wonderful examples of the effects of disruption. There have been hundreds of auto manufacturers in the United States, but only two have never filed for bankruptcy (Tesla and Ford). Now, all auto manufacturers are on the verge of massive disruption from autonomous taxi fleets.

Disruption means that stock pickers have to be smarter than ever.

You must be right for a long time: I mentioned that I bought Google stock in 2004, just twelve years ago. I’m only 42 now, so I still have over half of my life left. Will Google or Facebook or Tesla be relevant in 40 years? I’m not sure any of them will be relevant in even 5 years. Disruption is easy to see after it’s happened, but by then, your stocks have been clobbered. Will you be able to see it coming? Probably not.

Back in 2007, Blackberry and Nokia dominated cell phone technology. Where are they now?

Do you have the time (or desire) to do the research? I bought Facebook stock based on hundreds of hours of research. For a couple years before the company went public, I devoured every Facebook article that I came across. I studied Facebook’s plans. I studied its young leader, Mark Zuckerberg. I read articles written by folks who were bullish on the company and used them to form my own hypotheses.

More importantly, I also read articles from the naysayers (‘They won’t be able to take the site mobile.’) and tried to figure out if my hypotheses still held water. To be good at stock market research, you must have the time and the passion for it. Most don’t.

Warren Buffett Advice: Billionaire Warren Buffett is the most successful investor of all time. His holding company, Berkshire Hathaway, has returned an astounding 20.8% return since 1965 (the S&P 500 has returned 9.7% over the same period). If you invested $1,000 in Berkshire Hathaway at time of inception, you’d be worth over $10,000,000 today.

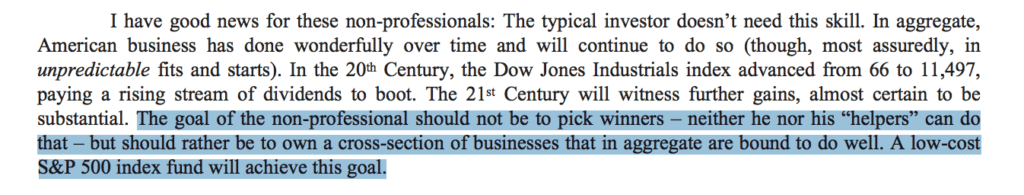

Wouldn’t it be great to hear Warren Buffett’s investing advice? Oh wait, you can. He mentioned in his 2013 annual letter:

Buffett famously advised Lebron James to do the same thing.

You are not a better investor that Buffett, so you’d be wise to listen up when he speaks.

I’m an Index Investor

So now, I invest newly earned money into index funds. I’m slowly selling down my stock portfolio and reinvesting it in index funds as well. I look forward to the day when I don’t hold individual stocks. I just don’t have a high level of confidence that I’ll be able to beat the indices over the long term.

The good news is that it’s easier than ever to be an index investor these days too. Open an account with a low fee provider like Vanguard directly. Or, sign up for a service like Betterment that takes advantage of Vanguard funds, but also adds an excellent tax loss harvesting feature (you can get up to 6 months of free wealth management if you sign up here).

After you’ve embraced the index fund, my final piece of advice for you is this:

Save and save hard. Find your level of Enough and get there as fast as you can. Never forget that money is nothing more than a facilitator. When you have all the money you’ll ever need, take your life in the direction of your dreams.

Read more: Best Brokerage for Index Funds

Photo credit:

InvestmentZen via Flickr – Creative Commons Attribution License

4 Comments