Should you pay off your mortgage early, or should you invest? It’s a great problem to have, but it’s also a major financial decision. Let me start by saying this:

I hate debt. Owing money feels terrible and dirty. I’ve been there.

Coming out of college, I had $60,000 in loans and it was suffocating. I can clearly remember the day that I made the final payment, 15 years later. I still have the letter that from Sallie Mae congratulating me on paying off my loans. Good riddance.

However, I willingly have mortgage debt. My current home set me back $176,000 and I had the money to pay cash. I briefly considered it, but instead took out a mortgage. I kept the money invested, mostly in an S&P 500 index fund. Let’s take a look at how the experiment is coming along.

Debt Rules! (sometimes)

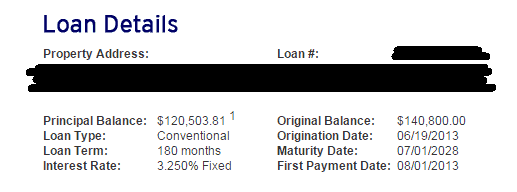

Back in June of 2013, I took out a mortgage for $140,800. I put down 20% to avoid PMI. The terms were 15 years at 3.25%:

The juicy details of Mr. 1500’s mortgage

I ran the numbers and as of 2/1/2016, almost 3 years into my loan, I’ve paid this in interest:

$11,355,97

Yikes. That is $11,355.97 that I’ll never see again. This isn’t small change. It hurts a little. But wait, I have something much better to show you.

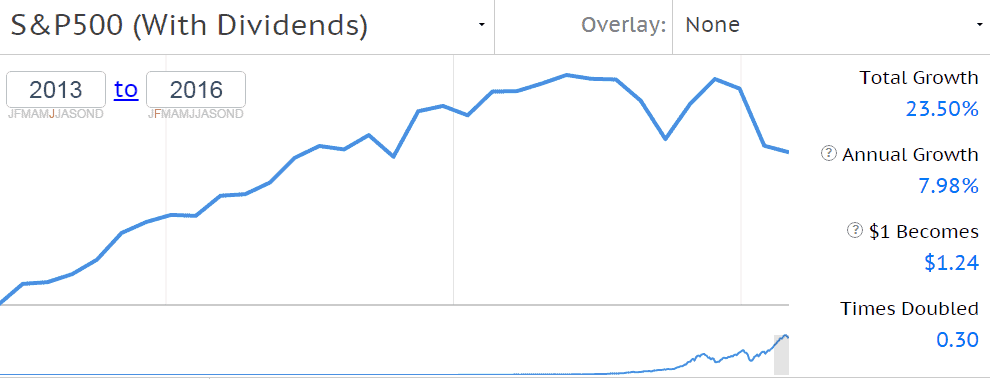

Here is a chart showing how the markets have performed since I took on my debt:

Thanks IndexView for the graph!

Let’s apply this performance to the $140,800 that I kept invested to see how I’ve done:

140,800 * 1.24 = $174,592

Did you see that number ladies and gentleman? My investment has grown $33,792 ($174,592 minus my original investment of $140,800).

That $11,355.97 isn’t so painful now, is it? I’m ahead – FAR ahead.

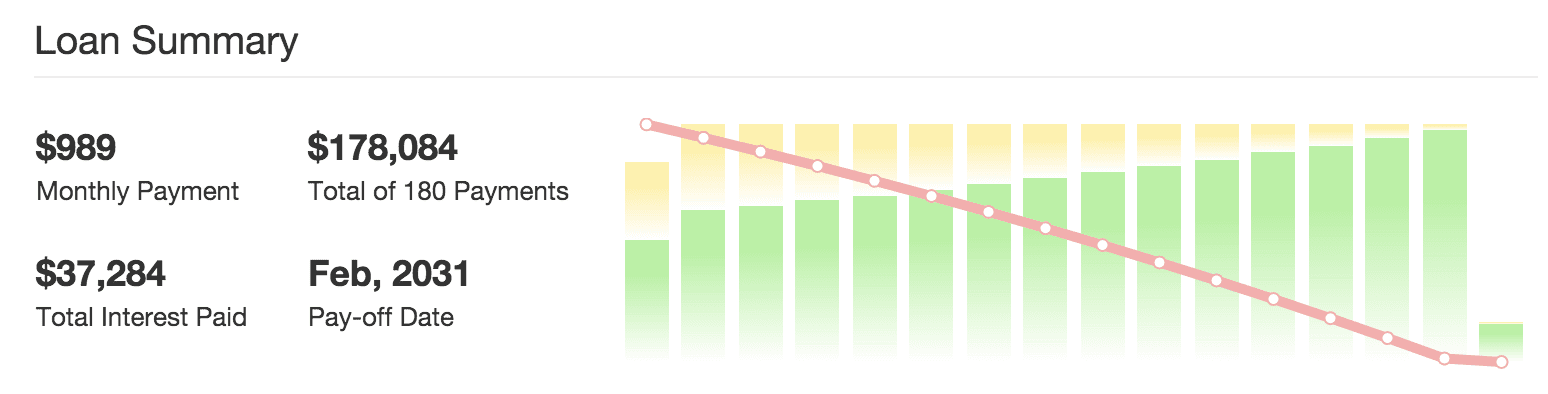

Another way to consider the numbers is to compare them with the total amount I’ll pay in interest:

Chart from Amortization-Calc

So, over the course of 15 years, I’ll pay $37,284 in tax deductible interest. However, less than 3 years into my loan, I’m up $33,792 on the invested money. I have a good chance of breaking even before the loan is 5 years old.

But wait, it gets better

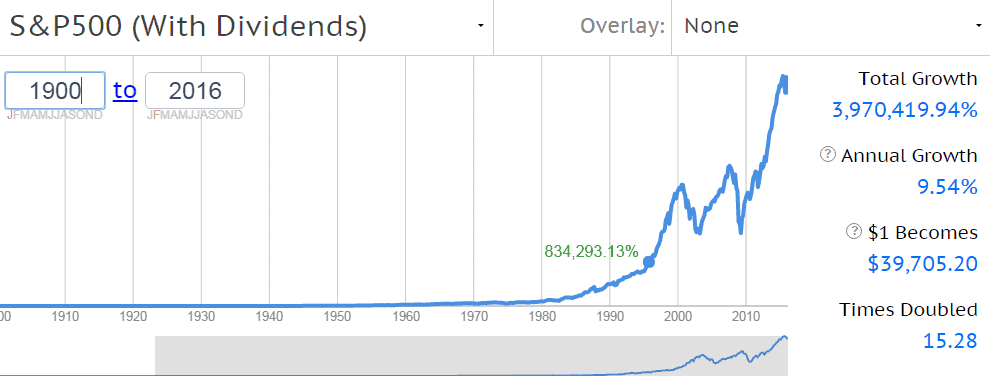

The recent performance of the stock market isn’t anything spectacular. I ran IndexView all the way back to 1900 which shows an average return of 9.54%. The performance of the markets in the time period that I’ve had my loan (7.98%) is below average:

All the way back to 1900

Even with the recent subpar performance of the markets, I’ve made almost 3 times more money from the index fund than I’ve paid in interest.

But wait, it gets even better

As great as my numbers look now, they will probably look considerably better down the road for two reasons:

1. Mortgage interest decreases over time

The earlier you are in a loan, the more you’re paying in interest. This is how all loans work. The first full year of my mortgage, I paid over $4,000 in interest:

Contrast that with the last full year of the mortgage when I’ll pay less than $500:

If I’m this far ahead in the early stages of the experiment, imagine how I’ll do at the end.

2. Compound interest is working for you

Your invested money works in the opposite way of the mortgage interest. Dollars reproduce like rabbits. Over time, those little guys will multiply like mad.

In the next calculation, I used a very modest return of 6%. Despite that conservative number, the results are incredible:

Chart from Dave Ramsey

Should I pay off my mortgage?

So should I pay off my mortgage? The numbers say no, I definitely should not pay off my mortgage.

Let’s review the numbers:

- On my mortgage of $140,800, I’ll pay $33,792 in interest over 15 years.

- If I earn just 6% on the investment, that $140,800 turns into $337,435.41 over the same period of time. This is a gain of $196,635.41.

You don’t have to be a math genius to know that $196,635.41 beats the pants off of $33,792. Mortgage debt, I like love you.

In this scenario, I shouldn’t pay off my mortgage early, and neither should you.

One more scenario

So, what if you’re saying to yourself:

I just hate debt and still want to pay off my mortgage. Instead, I’ll pay cash and invest invest the money every month that I would have put towards a mortgage.

In this scenario, you still come out almost $40,000 behind:

Thanks Dave!

Why is it so much better not to pay off your mortgage?

We live in an incredible period. Because of monetary policy meant to stimulate the economy, borrowing money is insanely cheap:

Thanks Financial Samurai for the chart!

This may not last much longer and once it’s over, it may not happen again in your lifetime. This is a gift! Take it!

If you took on your mortgage back when interest rates were much higher (5% or more), you should definitely consider refinancing your mortgage. You could potentially save tens of thousands of dollars. If you’re considering refinancing, you can quickly get rate quotes from multiple lenders here.

This isn’t for everyone

Before you implement this strategy, keep the following in mind:

- Know how to properly invest. The idea is to put the money away in a nice, low-fee index fund and forget about it. Don’t try to time the markets. Don’t fall for silly, short-term trading strategies or screaming people on financial TV shows waving charts. For a second opinion, see the advice of billionaire Warren Buffett – the most successful investor ever.

- This strategy isn’t for you if you’re into conspicuous consumption. The money you don’t use to pay off your mortgage is not to be used for a fancy vacation or a new car or some other silly piece of status. You may only invest it.

- Make sure you have a low rate on your mortgage. If you have good credit and are paying over 5%, you should refinance. Now. Take advantage of the current low interest rate environment and get banks to compete for your business by requesting a quote

at a comparison site like LendingTree. It WILL save you a TON of money in the long run!

The Peace Of Mind You Might Get By Paying Off Your Mortgage Early Will Cost You

The decision to leverage mortgage debt is controversial. Sean Cooper even wrote a piece for InvestmentZen awhile back explaining why he paid off his mortgage in 3 years instead of investing.

When I mention the benefits of leveraging mortgage debt to people, they frequently tell me this:

I just love the peace of mind that a paid off mortgage gives me.

Or this:

Any and all debt is bad! No thank you!!

I will never argue with folks who say that debt is risky because it certainly is. If you stop paying your mortgage, the bank will send over the local sheriff and remove you from your home.

However, I will always argue that being too conservative is risky too. If you have a long time horizon and your nest egg is in a bank account or CD, you’ll probably leave loads of money on the table. I don’t love that at all.

Do you know what I do love? I love cheeseburgers, chocolate mint ice cream and my family. But I digress. Even more than unhealthy food, I love the security and options that a huge pile of money gives me.

So go ahead and pay off your mortgage for short-term peace of mind. However, I encourage you to consider investing the money instead. Put those dollars to work for you. Long term peace of mind is better.

And if your mortgage rate is 5% or higher, you should strongly consider looking into refinancing while interest rates are low. You can quickly find some of the lowest refinancing rates available at a comparison site like LendingTree.

22 Comments