I think you’ll agree with me when I say:

As a real estate investor, managing a portfolio of 15 single family rental properties demands a ton of time and attention.

Or does it?

If you’ve always wanted to be a property investor but you’re too scared to start because you don’t want to be stuck repairing toilets at 2:00AM, I’d like to introduce you to my friend Tim.

Tim is a 35 year old real estate investor who owns 15 rental properties in Metro Atlanta. He targets single family residences that usually require about $10,000-25,000 in cosmetic rehab work before they’re rent-ready.

Since he started buying real estate in Atlanta in 2012, his US real estate portfolio has grown to $960,000 USD in equity, $14,000 a month gross rents, with net positive cashflow of approximately $6,000 per month after mortgage, expenses, and taxes.

So, why is this so remarkable?

So far, this sounds like your typical real estate investing success story.

But this isn’t the typical narrative where the upstart investor teaches himself how to do his own bathroom renos or learns to screen tenants after his first renter starts a meth lab in the basement.

A landlord’s worst nightmare. Photo Credit: Frank Ockenfels/AMC

Tim has never picked up a hammer to do rehab on his foreclosure properties.

He has never responded to a 2AM call from an irate tenant.

He has never posted an ad for his properties, let alone met any of his tenants.

In fact Tim lives halfway around the world in Hong Kong. Not only is Atlanta an 18 hour flight from home, but Tim also has a demanding career in finance where he regularly gets to work at 6:45AM and works until 7PM, sometimes later.

If a pipe bursts in Atlanta at 2AM and a tenant needs it fixed, Tim might as well be on Mars.

What’s The Key To Investing In Real Estate From Half A World Away?

At this point you’re probably wondering:

How is it possible for Tim to successfully manage a portfolio of 15 rental properties on the other side of the world, when so many investors struggle with just 1 property in their hometown?

How does he succeed where many others have failed?

1. Have a healthy cashflow buffer

Buying real estate doesn’t have much in common with buying paper-based investment assets like stocks or bonds, it’s much more like buying a business.

Many struggling business owners have a lightbulb moment when they read Michael Gerber’s classic business book, The E-Myth Revisited.

In E-Myth, Michael Gerber tells the story of his friend Sarah who learned as a child how to bake amazing pies from a dear Aunt. Sarah loved baking and dreamed of owning her own pie shop.

But 3 years after turning her dreams into reality, she was miserable.

“I get to the bakery at 3 in the morning and bake the pies, open the shop for business, take care of my customers, clean up, close up, take the money to the bank, have dinner and get the pies ready to bake for the next morning so I can start another long day. And this goes on 6 days a week, year-round.”

Sarah learns the hard way that running a pie shop isn’t really about the baking, it’s about running the business.

Just like running a successful pie shop isn’t really about baking, investing in real estate isn’t really about becoming an expert contractor or a seasoned property manager. It’s about running a business.

If a property only cash flows when the investor does all of the property management and maintenance work themselves, then much like the small business owner with a business model that doesn’t have enough profit to hire a general manager – the property owner is forced to show up to work.

Make sure you're buying a real estate investment, not a real estate job. Click To TweetCan your rental property’s cash flow support a business, or will you be stuck in the day to day operations like so many struggling small business owners?

Can You Afford To Hire Someone Else To Do It?

Many newbie investors get into a deal without factoring enough for vacancies, maintenance, rising interest rates, as well as the cost of hiring. Then they’re frustrated by the constant demands on their time and “unexpected” costs.

Even though Tim is an out-of-continent investor, because he only enters deals with healthy cashflow – even with management and maintenance costs factored in – he doesn’t have to be the one managing the day-to-day operations.

“I’m sure I could get better deals and better margins on rehabs by being on the ground,” explains Tim. “With property management and rental agents involved, I just have to buffer more room in my purchase to ensure that I have enough room to cashflow.”

It Has Nothing To Do With Being Remote

You don’t need to be managing a rental portfolio from halfway around the world to benefit from this lesson.

Paula Pant from AffordAnything.com also owns rental properties in Atlanta. Her story is the classic real estate investing narrative of hustling to do repair work and property management.

When talking about running the numbers on your real estate investments, Paula stresses:

“Remember, there are two players involved: Owner You and Worker You. Run the numbers so the Worker can quit, the Owner can hire a replacement, and the numbers stay the same.”

Interestingly, Paula also managing her properties remotely now. Coincidence? I don’t think so.

Treat your rental properties like a business and ensure that your cashflow includes plenty of buffer room for unexpected expenses and management costs – even if you’re doing the work yourself . Otherwise, you’re not really buying an investment, you’re buying yourself a job.

[thrive_lead_lock id=’1110′]

[/thrive_lead_lock]

2. Build a team of experienced, trustworthy professionals

As passive as real estate income can be, it always has a small active component. The key to minimizing that active component is to have a great team on the ground.

Tim spends on average 30 minutes each month to make sure everything is running smoothly. His management team has auto-authorization to make most decisions, but Tim goes over rental statements from his rental agent each month to make sure there aren’t any extraordinary expenses.

The rental agent sends funds to his US bank account, which is connected to a free Personal Capital account (you can sign up for one here), which he checks to ensure there are no issues with rental payments and to keep track of the progress of his real estate investments.

Once a year, he goes over the rental property slips and sends them off to his US accountant for taxes.

How Do You Build A Reliable Real Estate Team?

While Tim’s real estate investments act as a mostly passive income stream, this is only possible because he has a competent team he trusts.

Being an out-of-continent investor makes it especially important to have a good team. There are plenty of unscrupulous agents and turnkey companies who will take advantage of an out-of-town investor.

“You need to have reliable and trustworthy agents on the ground,” says Tim. “Relationships are key”.

Even though he has only spent a grand total of 1 weekend & 1 stopover in Atlanta, he has several agents on the ground who help him find good deals and place offers.

He has contractors that don’t overcharge for labor. He has a rental agent that screens tenants carefully.

But this didn’t happen overnight.

Tim interviewed over 20 agents in 3 other cities (Memphis, Detroit, Las Vegas) before finding agents he could trust in Atlanta. I asked Tim to share some of his tips.

Finding a Buyer’s Agent

Tim starts his search by doing basic online checks and due dilligence on the agents he contacts. “I check to see if there’s anything negative written about them online,” says Tim.

Once they pass initial screening, Tim reaches out to agents he wants to interview.

He keeps track of their responsiveness when he reaches out to them. “If they’re slow to respond when they’re trying to win your business, they’re going to be even slower afterward,” explains Tim.

The next step is the interview. “When you interview an agent, you want to find out their track record,” Tim goes on. “How experienced are they? If they have done similar deals before, have they just done 1-2 or 200? There’s a big difference. Also, you want to know if those deals attributable to them or were they assisting a larger team?”

Tim also wants to make sure his agents have a similar investment philosophy as he does. He wants his agents to have “skin in the game”, meaning that they have rental properties of their own.

He asks them to walk him through their bidding process and also asks for 3 references – previous clients that Tim will follow up with over the phone.

Once he finds agents that pass his initial screening, interview, and reference checks, he will work with 2 agents, and “split test” to find the best one.

Finding A Property Manager/Rental Agent

If you’re a small out-of-town investor, the truth is that there aren’t really any incentives for property managers and rental agents to pay close attention to your properties. If anything, there are significant financial incentives to take advantage of the unsuspecting owner.

So how exactly do you find someone who will look after your investments like their own babies?

“When I interview, I ask them how many properties they manage on their rental roll. I find out how many are currently vacant, and I ask them to describe the worst rental situation they have encountered and how they dealt with it. I make sure they have a good process for filtering prospective tenants, and I even make random anonymous calls to check on the responsiveness of the agent.

“But at the end of the day, what I’m really trying to find out is whether they’re motivated solely by money or whether they take pride in taking care of their clients,” explains Tim. “I look for people who aren’t motivated solely by commercial reasons.”

“The property manager I work with now is motivated more by the satisfaction of running her own business and taking care of clients. She’s motivated to do what is morally correct and she doesn’t buffer repair costs to add to her bottom line.

“In return, I make sure we compensate her fairly and allow her freedom in making decisions, especially when it comes to repairs. I think it works out to be a win-win for everyone.”

Work with people who aren’t motivated solely by commercial reasons Click To TweetEven with his vigorous screening process, it took some trial and error for Tim to build his team on the ground.

He has dealt with unresponsive agents, bought a mediocre property through an agent who wasn’t finding him very good deals, and he had to fire a property manager who was mismanaging his rentals while also trying to make extra money by overcharging for repairs.

3. Choose an area that meets your investing goals

If you can invest anywhere in the world, how do you choose the right country, let alone a city?

For Tim, choosing to invest in US property was about finding a risk to reward ratio that fit his investing goals.

“In 2012, I saw that the US housing market was getting very distressed and the numbers looked great. There were tons of fire sale properties and on top of that, I saw private equity firms like Blackstone were buying large SFRs in bulk.”

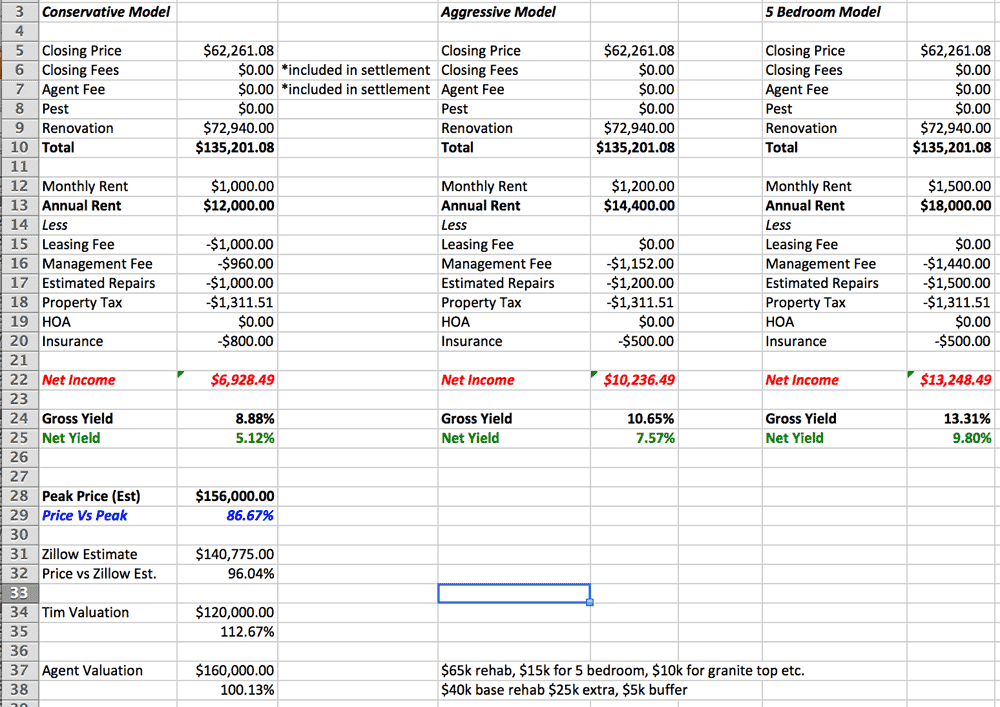

Knowing that Tim is a numbers guy, I pushed further for details on his selection process – was there a specific financial model he used to decide where he was going to invest?

“I did a high level screen on the most distressed markets and came to Las Vegas, Florida and Atlanta, but I also looked into Memphis and Detroit. I went with Atlanta in the end because I found someone on the ground I trusted.”

When I pressed for further details, Tim noted that when it comes to choosing a location to invest, it’s important not to get stuck in analysis paralysis.

While analysis is important, Tim has learned over the years that the most important factor is the ability to start small, pull the trigger and learn along the way.

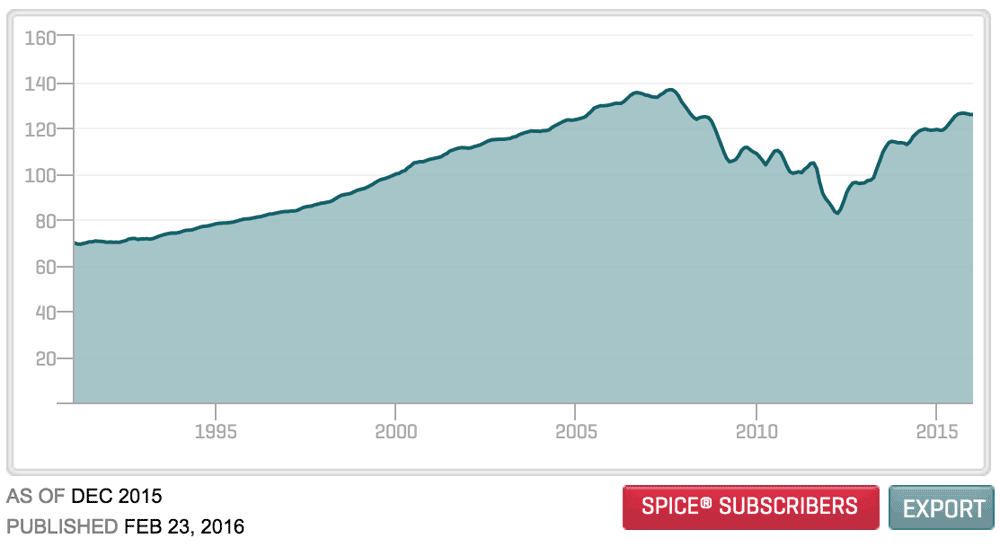

“To be honest with Atlanta, all the analysis we really did was I was comfortable with the city being a large city and a history of long term capital growth. You can access S&P/Case-Shiller data for that.”

The S&P/Case-Shiller Atlanta Home Price Index

“House prices were seriously at fire sale prices, even though they have risen, they are well below the previous peak’s highs so we are still quite comfortable buying here.”

“You can still find deals where property yields are higher than the financing rate, so over the long term capital growth is just cream to the investment. If I did my numbers properly even if the real estate market is flat for the next 10 years, which I doubt, I’ll still be making money.”

4. Choose the right neighborhoods

We talked about how you need to treat your real estate investments like a business and the importance of building a trustworthy team on the ground, but how does Tim actually go about finding the right properties when he’s halfway around the world?

In addition to using the experience of his agents on the ground Tim takes full advantage of the internet. “I setup a lot of email alerts on zillow.com on a suburb I’m focusing on. If you drill down to the county websites in any state in the US they usually have a lot of information about tax records and previous sales. I also use hotpads.com to check for comparable rents.”

“Recently, I’ve also been able to use my contacts to get direct access to the MLS, so I pull comps, but I did 13 out of 15 of my deals without MLS access.”

“I run screens for deals whenever I have time. I’m on a bunch of deal list and every time one comes up, I’d run it on Zillow to get an estimate for how much equity there is” says Tim. “I generally always try to buy under market value with real estate so even if the market is flat or not growing I still make money because there is some in built-in equity buffer, although this is getting harder in the current market.”

Once Tim spots a deal in the right neighborhood, he does some “virtual” due dilligence. “I have spent a lot of hours driving around on google maps before I purchase! I also make sure to search for the street name, high school, and county on BiggerPockets.com.”

Once he feels confident that there are no glaring issues with the area, he has one of his realtors on the ground send in a relatively low offer. He sends dozens of these offers each month even though most of them don’t get accepted.

Tim’s Key To Avoiding Landlord Horror Stories

When I pushed Tim for landlord horror stories, he didn’t have any to share. “I look at particular high income neighbourhoods where I know there will be no tenant issues and look for properties that are cheap – which usually means there’s rehab needed,” says Tim.

Every real estate investor knows how devastating bad tenants can be to returns. Tim’s approach to this problem is to buy in areas that attract quality tenants.

“Tenant screening is something most competent, trustworthy managers can do,” says Tim. “But you can also circumvent most potential problems by buying in a good area. Some of my properties are in neighborhoods where no matter who manages it, you aren’t going to run into very many problem tenants.”

“Choosing the right neighborhoods creates a virtuous cycle. Good properties near good schools tend to attract good tenants, which will make your property much easier to manage. This will increase your returns because of reduced turnover. says Tim. “Also, the properties will hold their value better, and your expenses will be lower because higher quality tenants will take better care of their home (your property)”

Focus On The Neighborhoods You Know

Now that Tim has the luxury of over a dozen remote deals under his belt, he realizes that he can just focus on the areas he knows are profitable and give him the least trouble.

“One of my new takeways after my recent trip is I think I should just focus on the areas where I have some good deals already and I know the neighbourhood. I should just look at every new listing that comes out of there and bid.”

Focus On Your Goals, Not Just ROI

While he has rental properties in Hong Kong as well, the high price-to-rent ratio makes those investments strictly an appreciation play. Many US markets on the other hand, offer cash-flow potential.

“You have to think about your long term financial goals,” says Tim. “For me, I needed something non-volatile, repeatable, low-maintenance that could provide consistent location independent passive income.”

“One of my biggest failures is I’m too risk adverse and perfectionist. I’m sometimes too focused on getting a great % ROI , which prevents me from scaling aggressively.

“As a personal investor everything you do depends on your goals, but really all that should matter is finding investments which offer consistent cashflow to replace a job / provide a safety net.

“I’ve learned the hard way that it’s really the gross cashflow your portfolio is throwing off each month that should matter, not what % ROI each investment is making. This is new metric I’ve been tracking for the past few years.”

“It’s better to have 10 deals that are returning 10% than have 1 deal that returns 25%. The numbers speak for themselves. The bulk of the cash-flow from our portfolio is on the Atlanta US property portfolio which only got built out 3 years ago.”

If you’re starting with very little capital, then spending time and effort uncovering that 1 amazing undervalued deal might be key to your success

But for those investors who are further along in their wealth building journey and have more cash to deploy, don’t let your obsession with finding the very best deals blind you from the bigger picture.

Final Thoughts

Of course Tim wouldn’t have been able to build his million dollar portfolio if he wasn’t already a diligent saver to begin with.

But even if you’re at a stage of your investing journey where you have more time than money, you can still take away a lot of valuable lessons from Tim’s story.

Many real estate investing articles focus on the endless pitfalls of managing agents, contractors and tenants. You read endless horror stories about nightmare tenants and just how time consuming and expensive managing rental properties can be.

There’s a good reason for this, since poor management and bad tenants can easily derail your real estate investing journey. Inexperience can cause big mistakes that make a good investment on paper, turn into financial nightmare.

There’s no way around the fact that real estate investing has a learning curve, and requires plenty of sweat equity to do it right. But as Tim shows, you can succeed where conventional wisdom says you wouldn’t.

But like Pat Flynn from SmartPassiveIncome.com always says:

“It’s all about working hard now so you can reap the benefits later.” With any passive income stream, you need to put the work up front to reap the benefits later.”

I’ll leave you with Tim’s biggest investing mistakes.

“I’ve learned that time in the market is more important than timing the market. Be careful you don’t get stuck in analysis paralysis and don’t pull the trigger with any kind of investing, whether it’s stocks or real estate or something else.

Time in the market is more important than timing the market. Click To Tweet“My biggest mistake was in a period of 2009-2010 when I didn’t buy any properties because I was too busy with work and had already invested in 1 property in Hong Kong and was comfortable. I ended up missing out on some good equity appreciation in the market.”

“So in summary, do your due diligence, but just set a process in place to keep investing in something no matter whether its equities, real estate or whatever. There is no secret, just do something consistently and you’ll see the effect of compounding like you see written in so many investment books. You will see the rewards scale enormously after 10 years.”

7 Comments