What is the average net worth by age of the typical American?

Before we analyze the numbers, it’s important to take a step back and gain a basic understanding of how wealth and net worth are related – or more specifically – how they are NOT related.

Thanks to the availability of cheap and easy credit, it’s pretty darn easy to appear wealthy when you’re not.

Average Net Worth By Age: Truth Vs Appearances

The first thing you should understand about net worth is that you cannot measure the average net worth of the typical household on your street by looking at what they own.

Just picture the Joneses with their large, stately home and white picket fence, two shiny new cars in the driveway, a backyard pool, and designer duds from head to toe. If you think they actually own it all, you’re probably in for a shock.

In reality, owning items of value isn’t how the Joneses keep up appearances – and it isn’t really the American way. Instead of saving cash to buy what we want, we borrow the money then brag of our good fortune.

And that’s exactly why the average credit card debt for households in debt surged over $1,500 last year. Because if we can afford the monthly payments on whatever it is we desire, we can convince ourselves we can afford anything we want.

The Real Measure of Wealth: Your Net Worth

But, that’s where reality ends and the truth begins.

Think about it; in reality, “owning” a huge and expensive mansion adds nothing to your wealth if you owe exactly what you paid, and the same can be said for cars, boats, and other big toys.

And if you owe a lot of money on credit cards or student loans, that amount can easily dwarf the sum of cash you have in the bank.

That’s why many experts suggest that there is only one real measure of wealth – your net worth. Your net worth is a figure you can reach by subtracting your liabilities from your actual assets.

Since your net worth actually compares your debts to your assets, it is the ultimate truth teller.

When you use net worth as a measure of wealth, you can’t hide behind fancy homes or expensive clothing – because, if you owe money on it, your net worth will show.

Average Household Net Worth by Age

So what is the average net worth by age of Americans?

Sadly but not surprisingly, the average net worth of Americans is paltry. Generally speaking, that’s because we save too little, spend too much, buy liabilities instead of assets, and piss away our discretionary income on pointless crap.

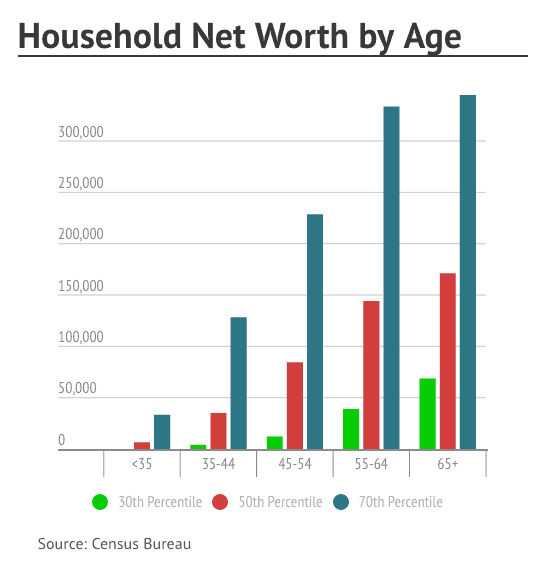

The chart below shows the U.S. median net worth by age, which properly illustrates the results of our often irresponsible behavior.

Using Census Bureau data from 2011 (the last year the government reported figures for net worth), we can chart the household median net worth by age in the U.S. and see how many of us have failed ourselves financially.

Imagine how the 50th percentile of those ages 35 – 44 has an average household net worth of just $35,000 – and that figure includes everything they own, any equity in their homes, and their retirement savings to boot.

That’s sad considering those ages 35 and older have had probably been out in the workforce for at least ten years at this point.

And even the 50th percentile of those ages 65+ aren’t doing much better; they’ve got a median net worth of around $171,135, and quite possibly decades of retirement ahead of them.

How do you think that is going to work out?

As the Motley Fool pointed out in their net worth comparison, an individual age 65 or older who has the median net worth of $171,135 in cash and investments could only count on $7,000 per year in living expenses.

While that might be okay for someone who has other income streams to rely on, like social security, it will likely spell financial disaster for others in this predicament.

What Is Your Net Worth?

If you’re like most people, you’re probably wondering about your own net worth right about now.

If net worth is the true measure of wealth, and it is, then finding out your own net worth is easily the best way to assess your own finances – and find room for improvement.

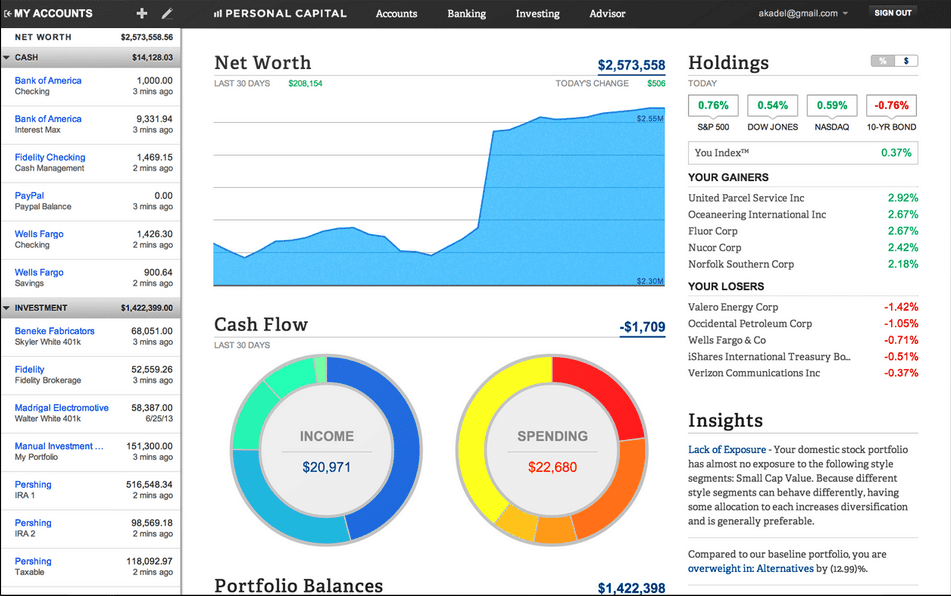

Fortunately, this step has been made easy by Personal Capital. By signing up for a free account with Personal Capital and linking all of your accounts, you can find out your net worth for free.

You’ll also benefit from receiving regular updates to your net worth as you pay down debt, grow your investment portfolio, and make incremental changes that boost your wealth over time.

Personal Capital even helps you accelerate your wealth building by identifying hidden fees in your investment portfolio.

It only takes a few minutes and it can change the way you build wealth forever. You can get your free account here.

Here’s a quick look behind the scenes at how Personal Capital makes it easy to quickly figure out your net worth, and how you can grow it.

If you want to get started with Personal Capital, just click here. If you don’t want to join Personal Capital for any reason, you can always figure out your net worth the old-fashioned way, too.

To accomplish this task, you’ll take out a piece of paper and create two columns – one for assets and the other for liabilities.

In the asset column, you’ll write out everything you “own,” including cash in the bank and your retirement and investment accounts. In the liability columns, you’ll tally up all your debts. Once you subtract your liabilities from your assets, you’ll arrive at your net worth. Brace yourself.

Here’s what net worth could look like for the average person with a mortgage, two cars, retirement accounts, and student loan debt:

| Assets | Liabilities |

|---|---|

| Home Value: $380,000 | Mortgage: $375,000 |

| 2013 Honda Prelude Value: $12,000 | Auto Loan: $15,500 |

| 2006 Honda Civic Value: $7,500 | Auto Loan: $0 |

| Cash Savings: $12,000 | Credit Card Debt: $16,000 |

| 401(k) Balances: $60,000 | Medical Debt: $4,000 |

| Roth IRA: $12,500 | Student Loans: $26,000 |

| Total Assets: $484,000 | Total Liabilities: $436,500 |

How to Increase Your Net Worth

The picture might not look too pretty when we look at the average net worth by age of your peers, but thankfully, what really matters is your own net worth – and you have the power to impact this right away by lowering your cost of living and making wise financial decisions.

If you figured out your own net worth and don’t like what you see, it’s never too late to start moving your money in the other direction.

Whether you owe too much or own too little, there are myriad ways to get begin building real wealth. And in reality, it’s amazing how some of the smallest moves can make the biggest impact.

Want to grow your net worth? Here’s how:

Pay down unsecured debt.

Since debt plays against your assets, paying off unsecured debt is a smart way to get your net worth moving in the right direction.

And if you are paying crazy interest rates or carrying around credit card debt or even crippling student loans, paying off debt can be a smart move for your finances regardless of your net worth.

There are a ton of different ways to prioritize your debts, but the most popular are the snowball method, which has you pay down your smallest balances first, and the debt avalanche method, which focuses on paying off highest interest debts above all else.

There is no wrong or right way to pay off debt as long as you throw as much extra cash towards your debts as you can. Equally important, however, is that you stop using credit altogether. The best way to get out of debt is to stop digging!

Take a closer look at your investment fees.

Whether you’re participating in a work-sponsored retirement plan or investing on your own, taking a closer look at your investment fees can be a truly eye-opening experience.

High fees could cause you to lose hundreds of thousands of dollars from your portfolio over the years, eroding your ability to save for the future.

You can use Personal Capital’s free fee analyzer to let you see exactly how much you’re paying in investment fees year after year – and how your fees compare to the benchmark average.

By minimizing your investment fees, you’ll be in the best position to boost your net worth over time.

Invest in income-generating assets.

Here’s where most Americans get it wrong when it comes to net worth.

Instead of investing in assets that could provide income or increase in value, we spend our money on depreciating assets ad nauseam – boats, cars, and clothes that are worth almost nothing when they’re done with them. Although some cars could actually be an investment and appreciate in value.

By investing in income-generating assets, on the other hand, you can put your money to use instead of watching it wither away.

Income-generating assets to consider can include anything from rental property to commercial real estate, Real Estate Investment Trusts (REITs), and dividend-producing stocks.

Heck, you could even invest some extra dollars in peer-to-peer lending – a type of investment that packages unsecured loans to people with various financing needs. Renting out your property is also a great way to make money. Your apartment, car and even your camera – there are many sharing communities that help lenders with just that.

Whatever you spend you money on or invest in, make sure it’s providing you with real value that will stand the test of time. And it doesn’t hurt to have some passive income coming in, either.

Contribute as much as you can to tax-advantaged retirement accounts

If you hate paying taxes, you’ve got at least one thing working in your favor; by contributing as much as you can to tax-advantaged retirement accounts, you can grow wealth faster and reduce your tax liability in one fell swoop.

In 2020, you can contribute up to $19,500 in most tax-advantaged accounts like the 401(k).

For married couples, that’s $39,000 they can set aside to grow tax-free for the future – and they won’t pay taxes on those funds until they begin taking distributions.

And if your employer offers a match on your retirement savings, you’re in an even better spot. With free money from your company, tax savings today, and the ability to grow wealth faster, maxing out your tax-advantaged accounts is almost a no-brainer if you can afford it.

The Bottom Line When It Comes To Average Net Worth By

The average net worth of Americans is just plain sad when you really stop and think about it. But you don’t want to be average, do you?

If you want to do better and get richer faster, pay attention to your net worth. While fancy clothes and homes are fun to own, they won’t make you wealthier automatically.

To grow real wealth, you need to pay less attention to what you “own,” and a lot more attention to what you “owe.”

And if your net worth is approaching zero, you simply owe too much.

Pingback: Are You Making Financial Decisions Like A Shark Or A Fish? - Frugal Rules