When I was in university, I just wanted to eat. After graduation, my goal was to pay off the $60,000 I had accumulated in student loan and credit card debt. In those early phases, my relationship with money wasn’t interesting. Money was just a raw tool deployed to meet basic needs.

I’m financially independent and life is different now. As my net worth approaches $2,000,000, money has a different and better purpose. Instead of deploying my dollars for utilitarian purposes, I’m using them to directly influence my happiness.

But I’m getting ahead of myself. Let’s back up to Phase 1 where I found myself deep in debt.

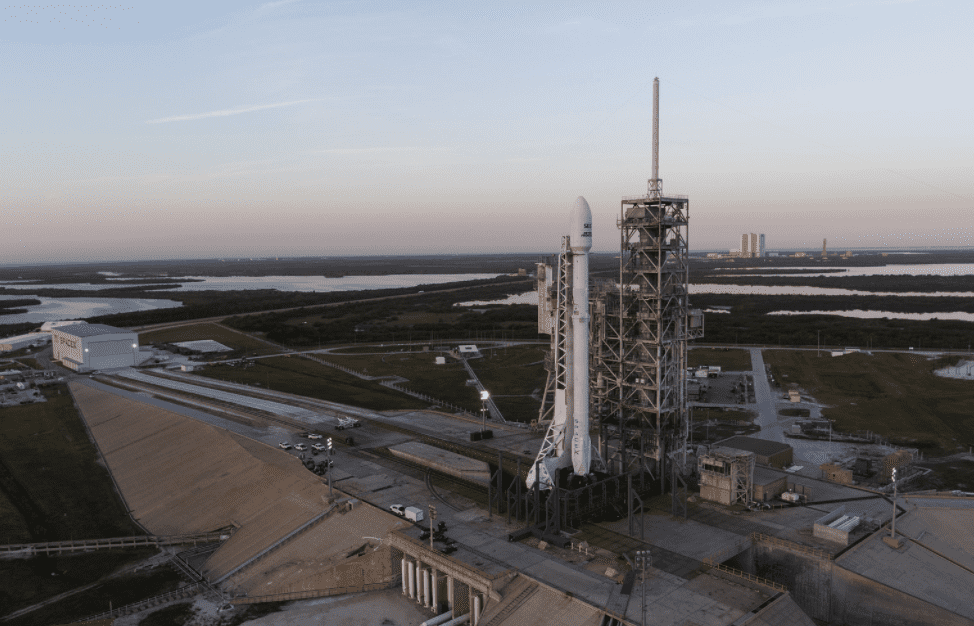

Phase 1: Preparing for Adulthood (on the launchpad)

This is the phase of our life when we’re financially standing still. Instead of building wealth, we’re arming ourselves with skills necessary to succeed as adults. This phase may end after secondary school or we may continue on to university or a trade school.

At the end of this phase, most of us have debt. Maybe it’s from college loans or you made some questionable decisions in your youth. I did both.

My family had no money, so I took out loans. I had a job, but it only paid $4.25 an hour. This didn’t stop me from ridiculous purchases like a $200 stereo. At the end of this phase I had $60,000 in debt; $50,000 in student loans and $10,000 in credit cards.

I’m lucky that my rocket didn’t explode on the launchpad.

Phase 1 Financial Goals

- Minimize debt: Live frugally, get a summer job and don’t make dumb purchases (like stereos).

- Maximize future earnings: Follow your heart, but follow your head too. You need to carefully consider your path in life. It may be fun to study art, but what are the career prospects? It’s hard to know what work you’ll enjoy, but I strongly suggest you consider an area of study with good employment prospects. Computer science is an excellent choice.

Phase 2: Hustle Baby, Hustle (liftoff)

The rocket has just lifted off. It’s not moving fast, but it is moving. The same applies to your finances.

You’re now done with school and have started a career. You’re trying to get out of debt and starting to save. There isn’t much money coming in, but at least you have income.

And it’s the perfect time for you to hustle. You don’t have kids yet and aren’t tied down with loads of obligations, so work harder than you ever have:

- If you’re a corporate cube dweller, you need to stand out. Come in early and stay late. Volunteer for the hard tasks and do them better than anyone else. Come up with creative solutions. Write down each and every accomplishment and remind your boss of them at review time. Then, ask for a healthy raise.

- If you work a job that has limited room for advancement, I have advice for you too. This is the gig economy. Embrace it: Rent your car on Tur0. Rent your bedroom on Airbnb and sleep on the couch or in the basement. Drive for Uber or Lyft. Take that extra money and sock it away.

Phase 2 Financial Goals:

- Get out of debt: There will be no new car for you at this time. Instead, pay off those student loans and credit cards. This is your number 1 priority.

- Increase your income: You can work 60 hours a week in this phase. You won’t be able to do that after you have a family. Work hard and get promoted.

- Consider an unconventional living situation: Instead of working for a house, make a house work for you:

- Get a roommate

- Buy a duplex where the rent from one half covers your mortgage

- Buy a neglected home in a good part of town and do a live-in flip

- Move back in with your parents

- Start investing: Even if you have debt, it may be a good idea to start saving. If your company offers 401(k) matching, contribute just enough to get the full match. A 100% return on contributions is still better than 23% debt on credit cards.

- Sign up for Personal Capital: This is a free service that aggregates all of your financial accounts into one secure dashboard. As your finances get more complicated, Personal Capital will help you manage them.

Phase 3: Gain Momentum (throttle up)

The rocket has left the launchpad and is now quickly gaining speed.

You’ve been promoted at your job. You’re also maxing out your 401(k) every year and saving on top of that.

It’s at this time that you notice something amazing. In good years, you make more money from your investments than you do from your job. Never forget that it’s better to make money work for you than to work for money.

It's better to make money work for you than to work for money. Click To TweetPhase 3 Financial Goals

- Resist lifestyle inflation: You’re making big money now, but you’re still not allowed to:

- Upgrade your house: I give you permission to move out of mom’s basement, but you don’t need a 5000 square foot home just because you can afford it. Why can’t a starter home be a forever home?

- Upgrade your car: Cars are chunks of metal that lose value quickly. $30,000 invested in the S&P 500 could be worth hundreds of thousands if given decades to compound. In the same time frame, the $30,000 car will depreciate to $0.

- Investing: By now, you have maxed out your 401(k) and have money to spare. Don’t get too smart. Stock picking is a fool’s errand. Stick to index funds. Consider a service like Betterment to automate rebalancing and tax loss harvesting.

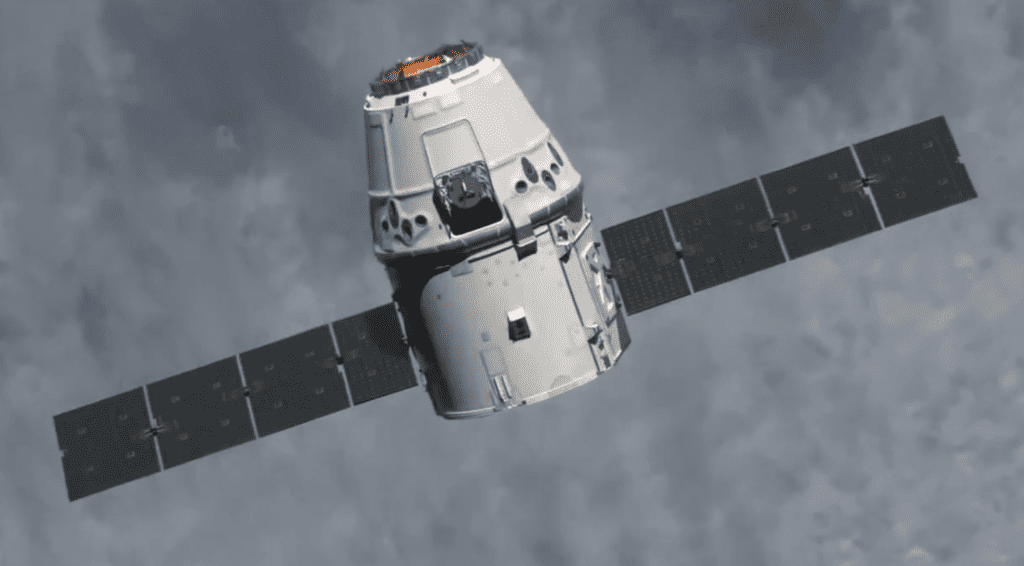

Phase 4: Freedom (orbit)

The engines are powered down and the payload is in orbit now.

The hard work is done. You’ve accumulated enough money to last a lifetime. You’ve bought the most important thing money can buy:

Options

And this is where it gets fun. You’ve earned enough money to never have to work again. You are now work-optional. If you love your job and can’t think of a better way to spend your time, stay there. However, I hope your life is richer than that. Consider going part-time or no-time. If you get bored, you can always go back to work.

And I have some more good news for you. There is only one rule now:

You can have anything you want as long as it doesn’t jeopardize your freedom.

Go buy a new car or a big house. Vacation in Fiji. Buy a vacation home on a lake. It’s all fine as long as you don’t have to go back to work.

Phase 4 Financial Goals

Your goal in Phase 4 is happiness:

- Find meaningful work: You can’t retire to nothing. Meaningful work is one of the keys to happiness. However, the definition of work here isn’t same as it was in phases 2 and 3. It may or may not give you a paycheck. The main purpose of this work is personal growth and happiness.

- Don’t get loose with the finances: You have a buffer, but keep the same fiscal discipline that got you to Phase 4. There is no need to show off; keep your wealth stealth.

- Grow: Now that you’ve freed yourself from the confines of the cubicle, you have time to read, learn and exercise.

And Don’t Forget to Live

One of the most tragic things I know about human nature is that all of us tend to put off living. We are all dreaming of some magical rose garden over the horizon instead of enjoying the roses that are blooming outside our windows today. –Dale Carnegie

I’m in Phase 4 of my journey. I left my job and only do work that makes me happy. I live life on my own terms and it feels wonderful. Every day is a new adventure. However I didn’t have the right goal setting process to get Phases 1-3 right.

I was frugal and invested wisely, but forgot to live. No matter where you are in life, remember to enjoy the journey. Take a couple moments every day to appreciate everything that you have. Make every moment count.

Now, I have something to ask you: Where are you going on your rocket?

Featured image credit: Pixabay

2 Comments