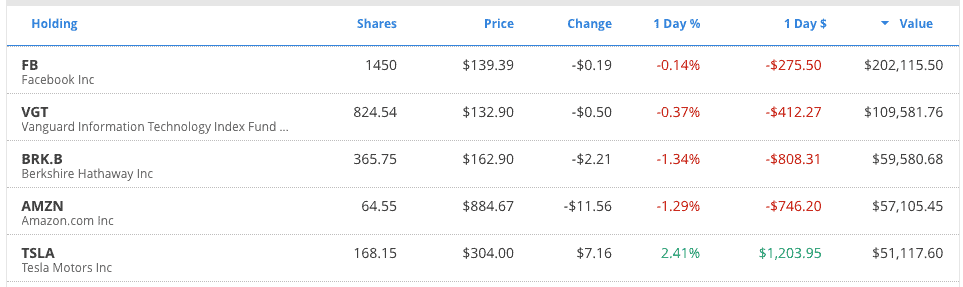

My investment portfolio is a mess. I have tech stocks including Google and Chinese internet startups. There is $30,000 in a REIT. I have over $200,000 in Facebook.

I’m all over the place:

My top holdings. What could possible go wrong? A lot!

The reason for my scattered portfolio is simple; it’s a relic of earlier thinking where I enjoyed stock picking and experimentation.

My allocation isn’t ideal and won’t be for a long time. I’d be hit with a big capital gain tax bill if I moved all of the money at once, so I’m rebalancing slowly. It will take years to complete.

And where is it that I want to be? Where am I moving my money to? What if I had a clean slate?

The mutual fund portion of my portfolio is about $1,000,000, so how would I invest it if I could start over again?

I’ll answer these questions, but first, let’s do a thought exercise.

Cube & Tray

Imagine a conversation where a salesman tries to sell you an ice cube service:

- Salesman: I have something new and cool to tell you about! I’m with Cube & Tray, an exciting new service. We take care of ice cubes so you don’t have to!

- You: What?

- Salesman: Yes, ice cubes! Cube & Tray will manage the ice cube production in your home. No need to fill your trays. We take care of it all! Our highly trained Ice Cube Artisans guarantee that you’ll never be without quality cubes.

- You: Is this a joke? Where is the hidden camera?

- Salesman: No joke here sir. Only the finest cubes. We take water and convert it to ice. For you. The phase transition from liquid to solid isn’t simple. Do you still remember your high school chemistry?

- You: Ummmm…

- Salesman: I didn’t think so. Keep in mind that we only charge 2% of your water bill for our service.

- You: My freezer already makes ice cubes automatically. There’s even a dispenser on the door.

- Salesman: We can do it better! Our experts make you the finest, most luxurious cubes.

- You: Go away before I call the police.

No sane person would ever sign up for Cube & Tray. Yet many folks sign up for a similar scheme to manage one of the most important aspects of their life – money.

Fees Will Eat Your Retirement

Until recently, I didn’t pay attention to mutual fund fees. I ignored and dismissed them:

Hey, it’s only 1 or 2 percent. No big deal.

It turns out fees are a big deal. A really big deal.

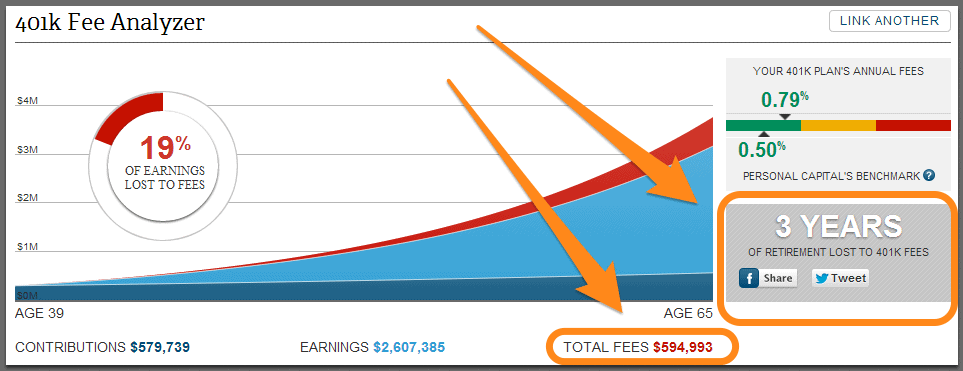

Back in July 2013, my investment portfolio was worth about $685,000. I had recently signed up for Personal Capital, an incredibly useful (and free!) service that aggregates investments. One of the tools on the Personal Capital site is the Fee Analyzer.

I fired it up one day and was shocked to discover that if I stayed with my current funds, I’d pay almost $600,000 in fees over the next 26 years; losing 3 years of precious retirement:

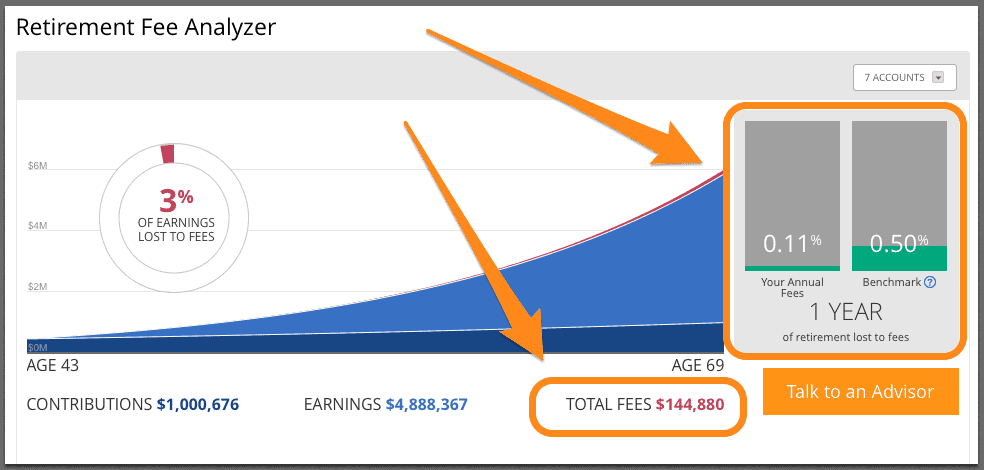

I took immediate action, rebalancing into lower cost funds. Even though the mutual fund portion of my portfolio is now worth $300,000 more than it was before I rebalanced, I’ll pay only $144,880 in fees:

By bringing my expense ratio from .79% to .11%, I saved over $450,000.

You can see how much of your retirement is currently being eaten up by fees using Personal Capital’s fee analyzer. It’s totally free!

Why The Fees Aren’t Worth It

The dirty secret of the investment world is that most actively managed funds, the ones with the high fees, fail to beat their benchmarks. This article from US News states:

A year-end study by S&P Dow Jones Indices found that “over the 10-year investment horizon, 82.14 percent of large-cap managers, 87.61 percent of mid-cap managers, and 88.42 percent of small-cap managers failed to outperform (their index benchmarks) on a relative basis.”

It’s incredible that one of the most important factors of long term success is fees, but it’s true. Low-fee funds that track an entire index usually beat their more expensive, actively managed counterparts. The simple answer is the right answer. A great read on this subject is John Bogle’s Little Book of Common Sense Investing.

The fact that the simple index fund is so successful goes against our intuition. And it goes against what we see every day:

- Why are there so many websites devoted to money management?

- Why do fund managers make millions of dollars ever year?

- What is the point of that screaming bald guy on that financial TV show?

The answer is simple:

There is loads of profit to be made from managing money. Money managers benefit if it appears complicated. If everyone knew how simple it really was, a lot of folks would be out of work.

This is why many financial advisors can afford to pay a very high price for wealth management leads.

If you’re still not convinced, consider that Warren Buffett, the most successful investor of all time, recommends index funds.

How To Invest $1,000,000 In 2025

So you want to know how to invest a million dollars: this is what I think would be the best way to invest 1 million dollars if I had to start over.

If I had a million dollars to invest today, I’d put most (at least 60%) of it into VTSAX. This is Vanguard’s total stock market index fund. It has an expense ratio of just .05% and provides exposure to the entire US equity market.

I’d put smaller amounts of money into VTIAX (Vanguard’s international stock market index fund) and VEMAX (Vanguard’s emerging markets index fund). Every year, I’d rebalance. I’d also take advantage of tax loss harvesting when markets drop. This is the best way to invest a million dollars – avoid high fee mutual funds, you do

And if that sounds like too much work, consider a robo-advisor like Betterment. Betterment automatically invests your money in low fee, Vanguard funds. The service also rebalances your portfolio and performs tax loss harvesting. It’s completely hands-off, and you don’t need a financial advisor. Investing has never been easier.

You could also consider real estate investment, and if you put in the effort you’ll likely get a higher return, but it isn’t a truly passive investment.

If you’re working with a smaller account, here’s how to invest 1000 dollars.

Let’s Make Some Money

Warren Buffett once said this about investing:

You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.

Successful investing is simple. Don’t sacrifice years of your retirement to an overpriced, underperforming fund manager. Embrace low fees and hold for the long term.

It really isn’t that much harder than making ice cubes.

Photo credit: jah~ If I had $1,000,000 via photopin

3 Comments