If you had to pick just one personal finance quote that everyone agrees on, what would it be?

I would choose:

“Compound interest is the most powerful force in the universe.”

After all, who doesn’t agree that we should save money, invest in the markets early, and put compound interest to work?

But as the title of this post suggests, I actually don’t think compound interest is as powerful as a lot of us think.

What Did You Just Say??!

I realize that questioning the power of compound interest is basically personal finance heresy, so before you break out the torches and pitchforks, let me say this:

Compound interest is extremely powerful…but there is another force that is even more powerful.

Before we get into all that, let’s take a step back and look at what makes compound interest so powerful in the first place.

Ever Heard Of The Magical Doubling Penny?

There are a lot of great ways to show the power of compound interest, but one of my favorites is the story of the magical doubling penny. It goes like this:

Would you rather receive $1 million dollars today or receive a penny that gets doubled every day for a month?

As it turns out, if you choose the $1 million dollars you’d be making a horrible financial mistake because a penny doubled every day for a month is $10.7 million dollars. Even the best compound interest accounts won’t match this in a lifetime, but it’s a helpful way to understand the concept.

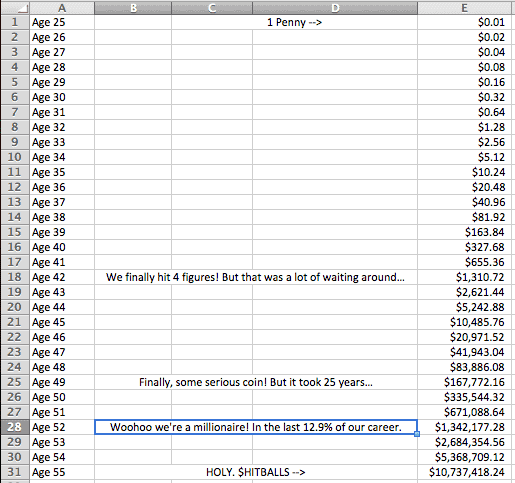

Funny enough when I did a Google image search for the doubling penny, I actually came across my buddy J money’s spreadsheet as the first result:

Clearly, J Money is as big a fan of this little thought experiment as I am! As J Money explains:

“Any time you doubt the power of compounding going forward, do yourself a favor and think of these little magical pennies here. In fact, do yourself one better and print off that image there to tape to your computer! That way every time you open up Amazon you’ll be reminded how much you’re really spending.”

I love it! Every penny you save is a freedom fighter in your army. Every penny adds to the trickling stream as it builds momentum, getting bigger and bigger until it eventually becomes an unstoppable, gushing river of money. Awesome stuff.

Its a fact – living within your means and investing wisely is the foundation of a strong financial house. Over the decades, compounding interest will work its magic and make you a millionaire.

But…

I would argue that living below your means and investing wisely is just the price of admission to the wealth building game. It’s only doing the bare minimum to harness the power of compounding in your financial life.

Why You’re Probably Not Harnessing The Full Power Of Compounding

As J Money explains, you can apply the magical doubling penny to your life by:

“INVESTING your money Right. Now.

Letting it ride for years and years and years and years (perhaps 31 of them? :))”

Investing early and letting it ride for 31 years will certainly do wonders for your portfolio, but I believe it’s only just scratching the surface of what compounding can do for your financial life.

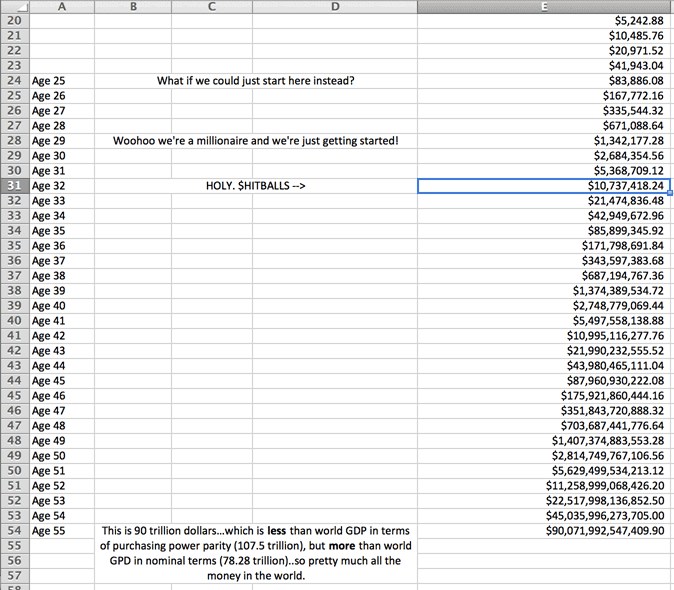

Let’s revisit the ol’ doubling penny chart, but now let’s imagine it as a working life of 31 years:

If we take a closer look at the parable of the magical doubling penny applied over a working life, it turns out the doubling penny only turns into significant money in the last 10 years. It only breaks $1 million in the last 4 years.

This tells us that compound interest isn’t that powerful unless we either:

- Start with a significant sum of money

- Wait for a long, long, LONG time to pass

It’d certainly be nice to retire a multi-millionaire after 31 years, but if you already have your spending under control and you’re investing regularly, why just stop there?

What if there was a way to apply the magical doubling penny to build your own millions, WITHOUT waiting around for 30 years?

I would argue that there IS another way to apply the doubling penny phenomenon to real life, one that is significantly more powerful than just waiting for time to compound your savings over the decades.

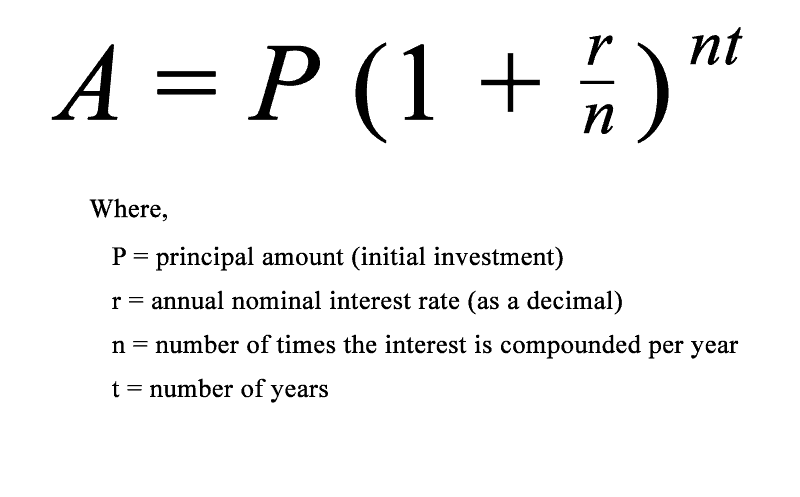

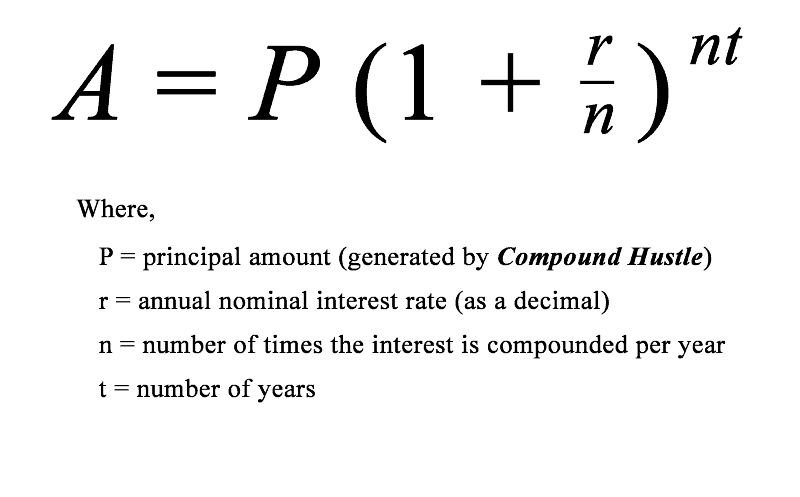

The Compound Interest Formula

Before we reveal this powerful force, let’s revisit the basic compound interest formula:

I can’t help but notice that there are a lot of variables here we can’t control:

- We have virtually no control over the rate of return.

- We have no control over the passage of time. Sure, we can invest early, but we’re still limited by our initial principal.

- Without something more, we have very limited control over our initial principal.

This formula only tells us what we can do with a given principal and a given rate of return over specified amount of time, but since we can’t affect those variables, we don’t really have much control. All we can do is wait for time to pass and for compound interest to work its magic.

To quote JD Roth from Get Rich Slowly (and now MoneyBoss):

“Time is the primary ingredient to the magic that is compounding.”

Conventional personal finance wisdom says that this is a feature rather than a bug of compound interest. Do nothing other than save and invest, and you’ll get rich over time. It’s that simple!

While this is 100% true, there’s another side to the coin (no pun intended)… you have absolutely no control over time!

That kinda sucks if you ask me. Unless you already have a lot of money, it takes a long freakin’ time for compound interest to work its magic.

Compound interest may be the most powerful force in a universe that’s 4.5 billion years old, but we only get 80 years.

So how do we replace time with a variable that we CAN control?

The answer is that instead of relying on compound interest as our primary wealthbuilder, we boost it with compound hustle.

None of us have control over the passage of time and it’s virtually impossible for the everyday investor to beat the market in the long run. But we CAN control hustle.

We can’t create more TIME, but we CAN take MORE ACTION.

The Power Of Compound Hustle

Compound hustle isn’t just some motivational fluff about working hard and being a go-getter — compound hustle is a real force, and its effect can be seen all around us.

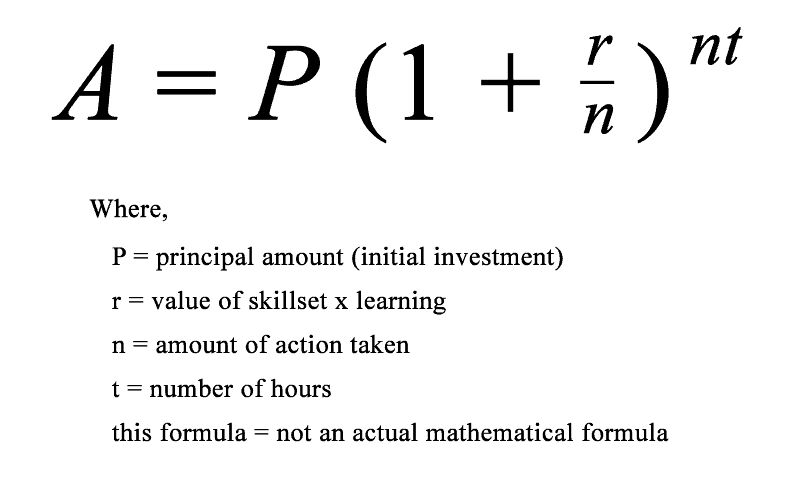

The Compound Hustle Formula

Compounding doesn’t just happen in the stock market. Compounding happens when you take action in your everyday life. It happens when you invest in yourself.

Compound hustle is about taking the same compounding effect that makes compound interest so powerful, and applying it to variables we can control. Instead of just waiting for the markets to grow slowly over time, we can take action every day. Compound hustle lets us earn outsized returns in areas of life that yield a lot more than 7%.

Compounding happens in your knowledge as you spend thousands of hours studying and thinking about a subject. It happens in the skills you develop through long, deliberate practice. It happens as you focus your most productive hours on pushing towards your goals. It happens when you show the grit to bounce back after repeated failure.

It happens when you’re exhausted after work, but you still choose to work on your side hustle instead of binge watching House of Cards on Netflix (or you binge watch because you’re totally hooked and season 4 is around the corner, but next time an addictive-looking show comes out you don’t check it out!).

By investing in yourself and taking action, you MAKE compounding happen.

Compound hustle is more powerful than compound interest because we’re not starting with a penny and waiting day-by-day for it to double. Instead, we’re creating pennies out of thin air. Heck, we can create stacks of hundred dollar bills!

We can’t create more time, but we CAN take more action. We can’t change stock market returns, but we CAN invest in ourselves, in our careers, and in our businesses.

Compound Hustle + Compound Interest = Most Powerful Force In The Universe

The magical doubling penny story shows how powerful compound interest can be, even when you start with a humble penny.

But what doesn’t often get discussed, is how the magical doubling penny also shows that compound interest is actually a very weak force if you’re short on time and money.

The true power of compound interest is unlocked when you already have a lot of money or when you have an abnormally high rate of return – it’s the magical doubling penny after all, not the magical 7% inflation-adjusted annualized return on $0.01 USD.

What if instead of a magical doubling penny, you had a magical doubling stack of hundred dollar bills?

Here’s a fun fact: if you start with a high 5-figure portfolio and double it every year, you don’t just get $10 million. You get…all of the world’s wealth.

Crazy, right?

But right now maybe you’re thinking that you don’t really need all the money in the world, you’re just looking for financial independence. You want freedom.

Well, compound hustle also shortens your time to financial independence.

Compound Hustle Is The Real Key To Wealth

The only way to fully take control of your wealth building is to utilize the power of compound hustle. Compound hustle is the key to unlocking the power of compound interest.

Compound Hustle In Action

So far we’ve only been talking about compound hustle as an abstract formula. Now let’s take a look at some concrete examples of how you might apply the magic of compound hustle to your life.

#1) The Resourceful Consultant

You earn $45,000 a year at your software engineering job. To supplement your income, you start consulting on the side at $100/hr. Not a bad start!

But you realize that freelance programming rates have a ceiling when it’s marketed as a commodity, so you start learning about digital marketing. You develop a strong understanding of SEO, email marketing, A/B testing, and UX design — specifically as they apply to the high value parts of software businesses like signup flows.

You start turning down gigs that are engineering only, and instead specialize in utilizing engineering to move marketing levers for software companies that have $10 million to $50 million / year in revenue.

By providing consulting services where you can add a couple million dollars to a company’s bottom line, your value proposition is powerful enough for you to drastically raise your rates.

By your 4th consulting gig, you’ve gone from $100/hr to $12k/week. Instead of putting up ads on freelance sites and hoping to find work (like every other freelancer), you aggressively seek out your target customers by going to conferences and getting coffee meetings with dozens of founders, just to land 1 client at a time.

You actively solicit testimonials and case studies from clients with successful outcomes and by year 2, you’re consulting full-time and your rate is $20k/week.

By year 3 your consulting rate hits $30k/week – an increase of 3468% from your $45,000/year salary just 3 years ago.

#2) The 21 Year Old Real Estate Investor

You buy your first real estate investment at age 21 with no knowledge or experience. You fix it up and manage to flip it for $20,000 in profit. You end up spending the profit from this first investment on a dream wedding, but you gain valuable experience.

You then buy a duplex and rent out 1 unit for rental income, which allows you to live in the other for free.

Because you have very little capital, you hustle to find partnerships that allow you to invest in dozens of rental properties with no money down. Your partner brings the capital, while you find the deals and make things happen.

You buy another duplex, then a 3-plex, a 5-plex, and eventually a 24 unit apartment complex using creative seller financing.

By your late 20s, you own 40+ rental units bringing in income every month.

#3) The Rags To Riches Entrepreneur

After graduating college with your business degree, you decide to pursue your dream of entrepreneurship, which results in you taking random odd jobs to learn about different industries. At the age of 26, you’re still living with your mom working jobs that don’t even require a high school diploma.

While working as a limousine driver, you devour business books during your long waits for your customers. After a customer asks you whether you can help him find a limo in New York, you spot an opportunity to create a website to help connect customers with limo companies.

As you’re working to pay the bills, you teach yourself to develop and market websites. You eat ramen noodles and stay home on Friday nights to regurgitate code while your friends are partying. To grow your site, you learn about search engine optimization, you do cold-calls, you mail letters you send out emails on an email marketing platform, you mail letters.

By age 31, you sell your website for $1.2 million dollars in 2000 at the height of the dot-com boom. When the website fails after the dot-com crash, you buy it back for $250,000 and over the next 18 months you build it back up.

By age 33, your business is bringing in over $100,000 in profit each month and you become a multi-millionaire. In 2007, you sell the business for $4.5 million dollars.

#4) From Skinny Nerd To Fit Nerd Blogger

As a skinny guy wanting to get fit, you start exercising in high school and college. But without any knowledge, you make constant mistakes and get 0 results.

After 6 years of trial and error, you finally figure out how get results from your training. In 2009, despite not having any personal training experience, you start a blog to share what you learn about fitness and nutrition with fellow nerds, with the moto to “level up your life, every single day.”

You write 5 days a week, working all evening after work to get your content published. After 9 months of writing 5 articles a week, you have no comments and only 90 subscribers.

You cut back to 2 longer, in-depth articles a week and start publishing guest posts on other websites, which helps bring in readers and your audience starts to grow. After 18 months, you quit your job to focus on your website full time, even though the blog hasn’t earned a penny.

You spend 2 months writing a book, and you sell 200 of them in the first week of your book launch because of the enormous trust you’ve built with your audience.

5 years later, your blog is bringing in nearly half a million dollars a year.

Is It Really Possible?

Do these examples sound far fetched? They shouldn’t, because all 4 examples come from real life.

Example #1 is Patrick McKenzie from Kalzumeus Software.

Example #2 is Brandon Turner from BiggerPockets.com.

Example #3 is MJ Demarco, founder of Limos.com.

Example #4 is Steve Kamb from NerdFitness.com.

These are all real life case studies of how you can use the power of compounding in your daily life to accelerate your wealth building, above and beyond anything possible with just compound interest.

Final Thoughts

To truly take advantage of the power of compounding, we can’t just wait around for our pennies to double. We need to supplement the power of compound interest with the power of compound hustle.

By applying compound hustle to our careers, our businesses, and ourselves — we take advantage of a compounding formula where the variables are within our control.

We all have different goals in life and different skills — maybe some of the success examples above might not be the right approach for you, but you can still apply the compounding effect to whatever hustle you choose.

Every project that fails, every rejection you receive, every bit of knowledge you gain, every positive habit you build – it compounds over time if you continue to take action.

Compound interest isn’t the most powerful force in the universe. That title belongs to compound hustle.

How are YOU applying the power of compound hustle to your life?

9 Comments