Congrats! You’ve paid off your debt, have a nice healthy emergency fund, a burgeoning retirement account, and even some extra cash to spare. So what’s next?

If you’re in a good place financially and have some savings, it’s time to start investing your money. While you may be a beginner investor and hesitant to take on the risk, keep it mind that starting earlier lets you:

- Start building your investing skillset when you’re most able to absorb risk

- Gives compound interest the time it needs to work its magic

Even though investing $1000 is not going to make or break your retirement, building that habit of saving and investing early is a big part of how most millionaires build their nest egg, as Thomas J. Stanley and William D. Danko showed in their classic personal finance book, The Millionaire Next Door.

So what’s the best way to invest $1,000? Before we even start talking about investing, the general consensus is that you should keep at least 3 months worth of expenses in cash for emergencies (also known as a “rainy day fund”).

So if you don’t have that safety buffer built up yet, before you think about investing (even in safe investments with high returns), we recommend opening a high interest savings account at an online-only bank or at Citi, and setting up recurring transfers from your checking account into your high yield savings account. But of course, you’d have to make sure everything is digitally secured, after all, digital security is a priority now, especially since we are now in the information-technology era.

This can earn you up to 1.70%, just for having cash in the bank. If your current bank account isn’t giving you a yield of at least 1.70% (as of 2020, most brick and mortar banks offer a fraction of this), you are leaving money on the table.

If you don’t currently have a high yield savings account, we recommend the CIT Bank Savings Builder account. They offer up to 1.70% interest on your savings, so if you want to start earning interest on your cash savings, you can claim your high yield savings account here.

Once you’ve done that, read on for our expert recommended “best way to invest $1,000 dollars”.

How To Invest 1000 Dollars

With as little as a $1000, you can start making your money work for you.

While investing 1000 dollars may seem like a small sum, almost insignificant sum (7% return on $1000 is only $70 you might be saying to yourself), it’s a great foundation to build on. So now that you have the money, where exactly do you start?

Even the most seasoned investor had to begin somewhere. We asked 22 experienced investors to answer this question: if you had only a $1000 to invest, what would you do?

Editor’s Notes

The answers from our panel offered some fascinating investing insights. Before we dive into the individual answers, let’s take a look at the numbers:

Best Way To Invest $1,000 According To 22 Experts

| Investing Approach | # Of Mentions | % Recommended |

|---|---|---|

| Low fee index funds & mutual funds | 16 | 72.72 |

| Pick stocks of favorite companies/sectors | 3 | 13.16 |

| Start an online business / side hustle | 3 | 13.16 |

| Professional development & education | 2 | 9.09 |

| Pay off debt | 2 | 9.09 |

Our group of seasoned investors overwhelmingly favored a long-term, diversified investing approach — rejecting individual stock picking and actively managed funds — in favor of low-fee index/mutual funds that track the broader stock market.

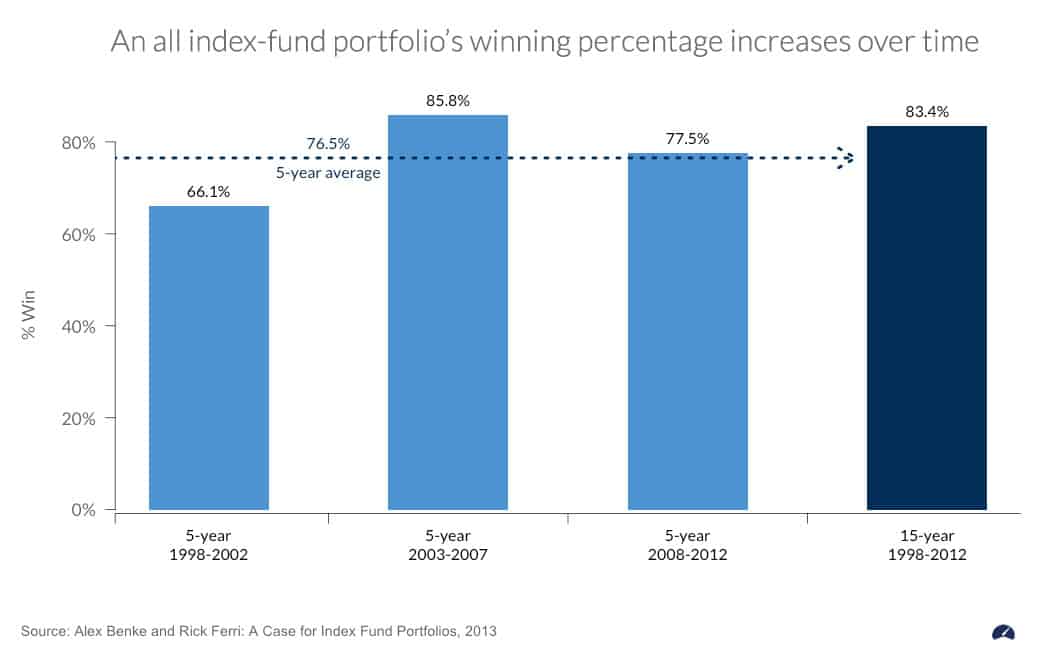

The data seems to back up our panel’s advice – a white paper published in June 2013 by Rick Ferri and Alex Benke compared all-index portfolios against comparable actively managed funds and found that the all-index fund portfolio outperformed the actively managed funds by 83.4% over a 16 year period (1997-2012).

This is an important investing lesson: if low-cost index funds can get beat professional stock pickers 83.4% of the time, what chance does an amateur have?

Most rookie investors dream of picking a winning stock that quickly turns their $1,000 into $10,000 or even $100,000, but our experts (and the data) tells us that this simply isn’t how investing works.

How To Start Investing In Low-Fee Index Funds

16 of our 22 panelists suggested low-fee index funds as the best way to start investing with $1,000, and the data backs them up. Almost all of them suggested investing through Vanguard. The answer seems clear, but you’re not a financial expert, so how can you get started?

Although putting together a balanced online portfolio of Vanguard ETFs is relatively easy to figure out, even for non-finance nerds, there is definitely a learning curve.

If you want all the benefits of low-fee index investing but:

- You’re scared of making mistakes

- You don’t have any interest in putting in some time to learn the ropes

- This is the first time you’ve even heard the term “index fund”

- You’d just prefer having an expert to do the work for you

Then the easiest way to get started is through a robo-advisor like Betterment.

In fact, Betterment was the most highly recommended robo-advisor by our panelists (mentioned 3 times). Not only is it a simple way to execute the investing strategy suggested by 16 of our 22 panelists, but it’s 100% automated.

Betterment and other robo-advisors act like an extremely low-fee financial planner – except instead of talking to a human advisor, Betterment’s software algorithms will build a portfolio of low-fee index funds (including Vanguard funds) for you.

This means much lower-fees for you compared to traditional financial advisors, which means more money in your pocket.

How Do I Get Started?

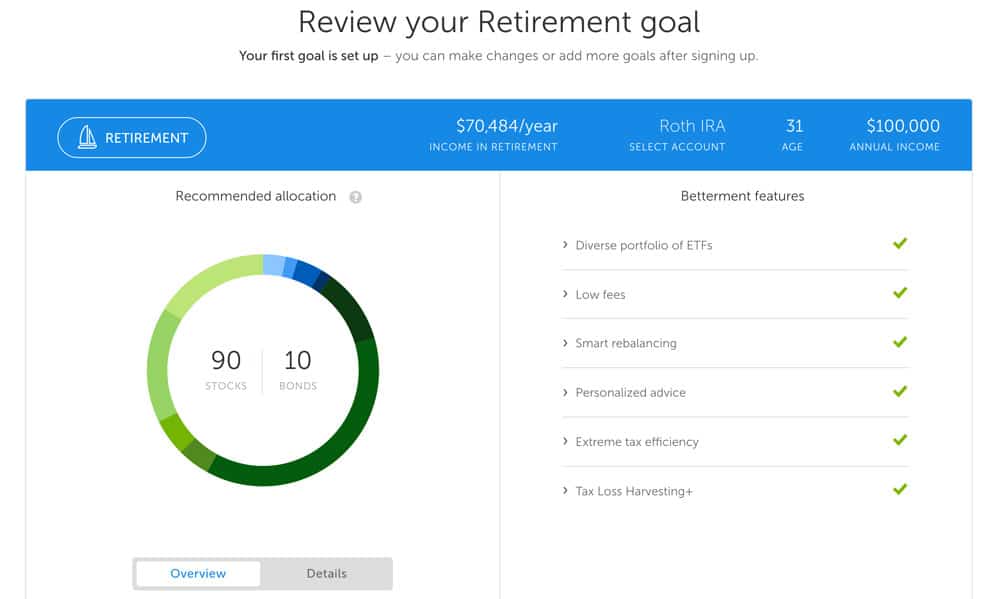

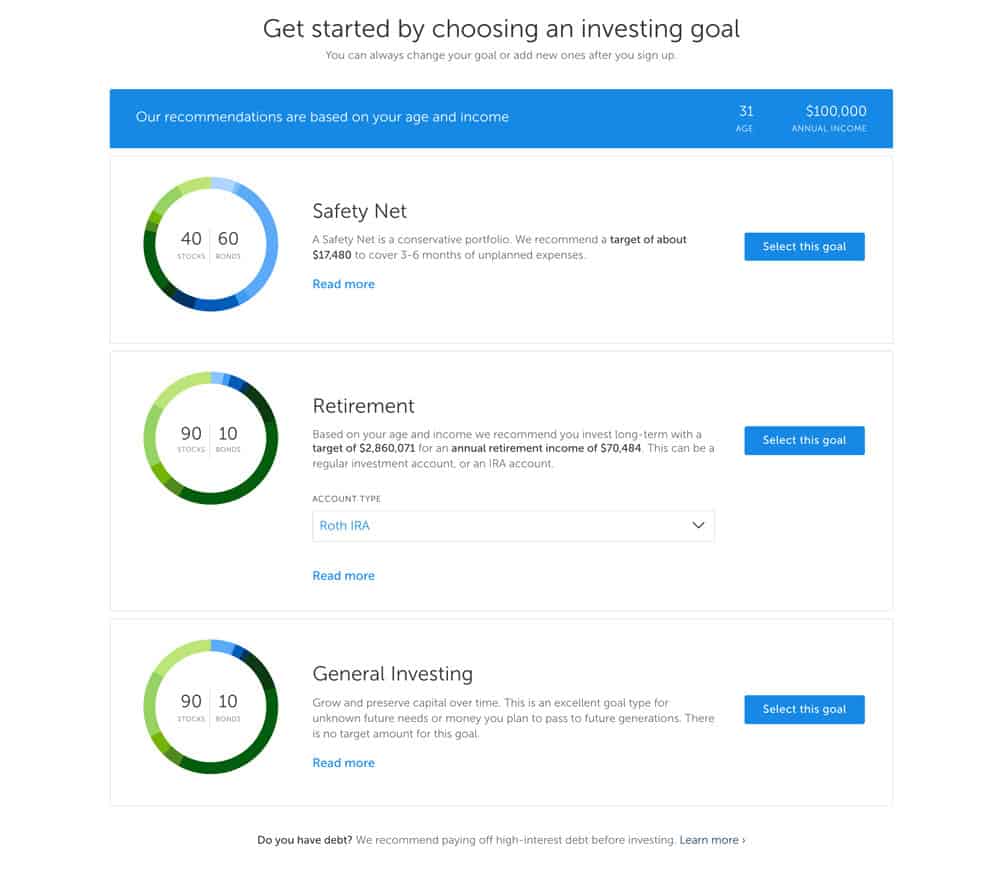

Once you visit their website, Betterment will ask you a few very simple questions to figure out your retirement goals and your risk tolerance.

Based on your information, Betterment’s algorithms will construct and manage a portfolio of low-fee index funds to help you hit your investing goals.

The initial setup process only takes a few minutes, and from then on Betterment handles all of the asset allocation and portfolio rebalancing for you. They also do other nifty things like tax-loss harvesting which can increase your overall investing returns and can be tricky to do manually without software assistance – even for finance nerds.

If you want to get started investing in low-cost index funds through Betterment, you can sign up through this link. You can also go directly to Betterment’s website, but if you sign up through our link, you can get 1 month of Betterment free.

What If I Want To Turn My $1,000 Into $100,000?

If you came to this page trying to figure out how to turn your $1,000 into $100,000 overnight through some super secret multi-bagger stock pick, we’re sorry to tell you that all of our experts agree – there is no such magic bullet (and if there was, why are they wasting their time selling you the secret?).

However, that doesn’t mean our panelists didn’t have any advice for those of you who dream of turning your $1,000 into life changing wealth. 3 of our panelists suggested starting a low-capital online business as the best way to turn $1,000 into millions of dollars within a decade.

It’s definitely not an easy path and you could potentially lose your $1,000 – but as one of our panelists puts it:

“Even if the business fails, you’re likely to learn significantly more than $1,000 in business lessons.”

If you’re still planning on trading stocks, make sure you’re using the best online brokerage for beginners.

How To Invest 1000 Dollars (Expert Panel Answers)

Here’s the best way to invest 1000 dollars, according to 22 seasoned investors:

1. Focus on diversified, long-term investments

“If I was a beginning investor and I had $1000 to invest, I would do my best to invest in a diversified, long term investment like an index fund.

“One of the easiest ways to do this as a beginner is to invest with a robo advisor service like Betterment or WiseBanyan, although to keep costs even lower I’d probably prefer to invest directly with a low cost company like Vanguard.” says Peter Anderson of Bible Money Matters.

2. Think about the future

“The best place to invest $1000 is in a Vanguard Target Retirement Fund. Do it quickly, then get back to concentrating on how you really build wealth- increasing your income and your savings rate. At that level of savings and that size of portfolio, future contributions matter far more than how that money is invested.” says Jim of White Coat Investor.

3. Start with debt

“First I’d pay off consumer debt with the $1,000. Next, I’d open a Roth IRA and invest $1,000 in Vanguard Total Stock Market Index Fund-VTI” says Barbara Friedberg of Barbara Friedberg Personal Finance.

4. Go with the Vanguard STAR Fund

“I’d suggest a beginner with a $1000 simply buy Vanguard STAR Fund (VGSTX). It’s a good mix of 11 Vanguard funds, which are themselves diversified among many companies.

“The expense ratio is a little higher than most Vanguard funds, but still low enough to not be a concern. Conveniently the minimum amount necessary to invest is $1000.” says Lazy Man And Money.

5. Start simple with a Roth IRA

“The first thing I would do is open a Roth IRA. Inside the Roth IRA I would keep it simple and put the money into a very low cost index fund. Later, once I gained more confidence, knowledge, and experience with investing I would branch out to other types of investments.” says Jason Cabler of Celebrating Financial Freedom.

Read more: How To Invest in Stocks for Beginners

6. Explore everything possible

“I’d wish to get buried in the safety of an index fund. But being a person who’s just starting out learning the skills of the trade, I’d like to explore everything possible with my $1000.

“I’d buy a few stocks of my favorite company (or companies). I’d buy a little piece of a mutual fund (with low fee) too. I’d also venture into $200B online ad market by building a site, which I’d commercialize in due course.” says Sudipto Basu of One Cent At A Time.

7. Think carefully, choose wisely

“I’d invest 50%, I’d use 25% for my mortgage (debt) and I’d have some fun with the other 25%. This means my “found money” priorities are saving for the future, killing existing debt and having a little fun. That sound just about right. In the end, what you value is usually a reflection of where you spend your time and what you spend your money on. Choose wisely.” says Mark Seed of My Own Advisor.

8. Open a brokerage account

“As a young adult with $1000 and a long investment time horizon, I would open a brokerage account at Vanguard and buy a combination of low-cost ETFs. I would divide the money roughly into thirds to purchase: Total US stock market index (VTI), US small cap value index (VBR), and developed International index (VEA).

“If I didn’t feel like I could manage my own portfolio, I would put all my money with Betterment.” says Jacob of Cash Cow Couple.

Read more: How to Buy Stocks Online

9. Invest in a mutual fund

“If I had $1,000 to invest, I would invest the money into a mutual fund broker or ETF that tracked the market, so something along the lines of an S&P 500 Index fund. It’s boring, but I know if I leave it alone, over time it will grow nicely for me.

“If I were older, I would pick a mutual fund or ETF that was balanced (meaning it held both stocks and bonds). A key point to not overlook is costs, as over time they really take a bite out of your investments.” say Jon of Money Smart Guides.

10. Start a side hustle

“If I had just $1,000 to invest, then I would use it to start my own side-hustle business. I would then commit all revenue from that side-hustle business to purchase other income producing assets to create a virtuous cycle of passive and portfolio income growth.

“The key point is I would limit my spending to my regular day job by reinvesting all new income from the side-hustle and other acquired assets until my passive income exceeded my expenses. That’s how you make a $1,000 become something that changes your life.” says Todd Tresidder of FinancialMentor.com.

11. Go for a Vanguard S&P Index Fund

“Assuming that we are talking about investing long-term for retirement or something at least 10 years out, I would take $1,000 and put it in a Vanguard S&P index fund – low fees and a great website to help the first-time investor get started.” says Bob of Christian Personal Finance.

12. Put it in an index fund

“If I had $1,000 to invest, I would put it in an index fund. Indexing allows for diversity, and the chance to take advantage of the performance of an entire segment of the market rather than worrying about whether or not you’ve picked the “right” investment. I like the idea of a fund that offers dividend payments as well.” says Miranda Marquit of Planting Money Seeds.

13. Think long-term, even if boring

“If I had $1,000 to invest I’d go the boring approach and put it in a low-cost index fund, likely through somewhere like Vanguard. This may not be the most “exciting” way to invest it, though I believe it’s the soundest strategy for someone who takes a long-term view of investing. I like to take a relatively lazy approach to investing and that would do the trick.” says John of Frugal Rules.

14. Follow the broad stock market

“If I had $1,000 to invest, I would invest it in a low cost index fund that follows the broad stock market. This would be a great way to start getting used to the idea of investing. Then I would continue adding to my investment using dollar cost averaging.” says Lance Cothern of Money Manifesto.

15. Make it a family affair

“If I had $1000 to invest, I would actually make it a father and son activity. First I would find a low cost or free investment platform such as Loyal3 or Betterment. Together my son and I would research some of our favorite companies, split the investment between two or three of them, and then watch it grow together!” Brock Kernin of Clever Dude.

16. Think passively

“I’d open a Roth IRA and put the money into a low cost index mutual fund. That means it’ll be cheap to invest, will grow tax-free and it’s a pretty passive way of making money. The earlier that money gets invested, the better.” says Will Lipovsky at First Quarter Finance.

17. Start immediately but understand why

“The thing that I would do with $1000 is ask whether or not I should be investing it, and if I am investing it, why? Usually with an amount as small as $1000 I would recommend an index fund or Retirement Target Date Fund. The real key with investing is to start immediately and never, ever stop learning.” says Hannah Rounds of Unplanned Finance.

18. Invest in yourself

“I’d invest $1,000 in professional development. I’m always eyeing online courses to continue building my skills.” says Kate Dore of Cashville Skyline.

19. Pursue a small business idea

“If I had $1,000 to invest I’d invest it in one of two things: a small business idea that didn’t require a lot of working capital (even if the business fails you’re likely to learn significantly more than $1,000 in business lessons) or in a low fee mutual fund/ETF such as Vanguard.” says Will of Doctor of Credit.

20. Invest in established companies

“With $1000 to invest, I would like to play the Lottery. Don’t be serious, I’m just kidding. I would like to invest the $1000 in stocks with focus on some established companies. Or may be I can use the money to invest in Mutual Funds and Bonds through some local banks.” says Peter Christopher of Finance Care Guide.

21. Educate yourself

“$1000 is not a life-changing amount unless you can find a multibagger stock (100x kind) to invest in. But that is tough. So the next best thing I can suggest is to invest in educating yourself about Investing & Money Management.

“It might look like an unnecessary expense at first, but it goes a long way in ensuring that you become rich in future and more importantly, stay rich.” says Dev of Stable Investor.

22. Think outside of the box

“I know most personal finance bloggers are going to say they would invest in index funds. That’s not a bad idea, but I’ll offer a more creative answer. If I had $1,000 to invest I’d purchase more shares of IZEA. IZEA is a company whose stock can realistically double or triple in price over the next few years and I would absolutely use the $1,000 to add additional IZEA stocks to my portfolio.” says David at Young Adult Money.

Do you agree with these experienced investors? Tell us below how you would start investing with $1000.

Want to make investing really easy? Read about the Motley Fool’s flagship product in our Motley Fool Stock Advisor Review.